|

The big news last week came on several fronts. First, at the close of their two-day meeting, the Fed announced, “the economy has made progress this year” and the central bank would continue to “assess progress in coming meetings.” It is expected that the Fed will begin to reduce its bond-buying program of $120 billion a month later this year. The central banks’ next meeting is September 21-22.

Second, the U.S. economy grew rapidly in the second quarter and exceeded its pre-pandemic size. GDP grew 6.5% in the second quarter compared to the 6.3% growth rate during the first three months of 2021. The down side to this is that the results came in below economists’ estimates.

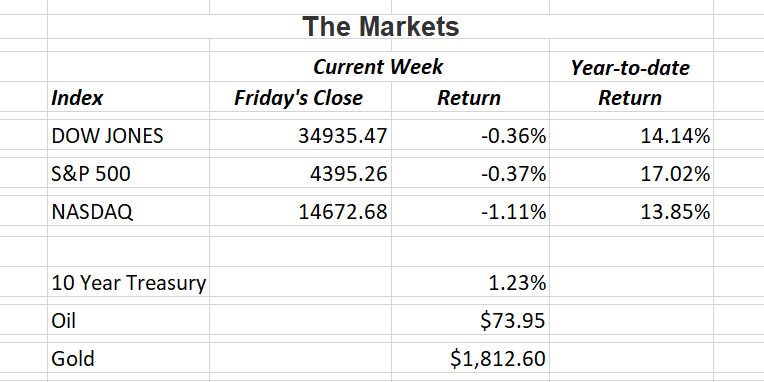

Last but not least, Amazon.com’s shares fell 7.6% on Thursday after the giant online retailer reported sales slightly below analysts’ estimates. This resulted in Nasdaq ending the week down a little over 1% while the Dow Jones Industrial Average and the S&P 500 posted a loss of about 0.35%.

On the earnings front, 59% of S&P 500 companies have reported second quarter results according to FactSet. Of those companies reporting, 88% have reported earnings per share above analysts’ estimates. That’s well above the five-year average. If this trend continues for the rest of second quarter results, it will be the fourth-largest earnings surprise since FactSet started tracking the figures in 2008.

I’ll continue to keep you updated on the latest news.

|

|

If you have any questions, please contact me.

The Markets and Economy

Offices in Chicago, Kansas City, St. Louis, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors.

|