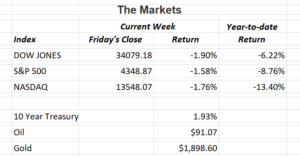

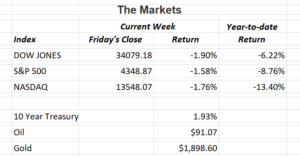

The Dow Jones Industrial Average posted its worst day so far in 2022 as the benchmark closed the week down -1.90%. The S&P 500 and Nasdaq posted similar losses perplexing investors. The conundrum comes as most companies continue to report strong earnings.

Over 80% of S&P 500 companies have reported 4th quarter 2021 earnings. Of those companies, 77% have reported earnings above the mean estimate. On average, earnings have beaten estimates by 8.5%. So why is the S&P 500 down almost 9% so far this year?

There is no way to know for sure how a stock will react to its earnings release; even if they beat expectations, negative forward guidance could cause a drop in share price. Alternatively, companies that fall short of expectations could see share price appreciation from investors that are looking to capitalize on future growth. In the end, there are so many different aspects to a company’s earnings release that makes it difficult to discern exactly what is causing movement in a company’s stock price.

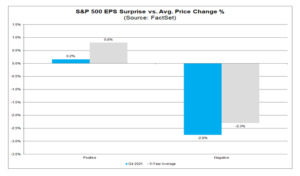

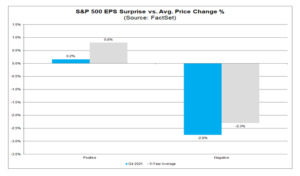

With that in mind, it does seem that companies that are missing their earnings estimates are being punished severely (Meta/Facebook) and those that are beating estimates are being rewarded less than they usually are. The chart below from FactSet shows how stock prices have fared so far this year. The blue bars are earnings reports for the 4th quarter of 2021 and the gray bars are for the five-year average. You can see the five-year average (gray bar) is much greater on the left meaning those companies beating estimates are not being rewarded as they historically would be. However, the blue bar on the right showing those companies missing analyst estimates is dropping more than their five-year average (gray bar).

When you throw in all the concerns I mentioned in last week’s market commentary, you can see why the market is having trouble finding solid footing. This means investors may see the stock market as “fairly valued.”

Even though investors may be worried about future growth, with earnings as strong as they have been, I remain bullish on the stock market. If you have any questions, please contact me.

|

The Markets and Economy

- The producer price index jumped 1% in January from the prior month. Over the last 12 months, prices at the producer level rose 9.7%

- Some Fed officials are favoring a move to selling some of the $9 trillion in fixed income investments the central bank holds. Along with raising short-term interest rates, this strategy provides another tool to help the Fed fight inflation.

- U.S. farm owners are taking the brunt of inflation hits. Higher prices for fertilizer, seeds, equipment repairs and seasonal labor are all having a devastating effect on farmers.

- Another way of looking at the trade deficit with China; for every $1 of goods that U.S. companies exported to Chinese buyers in 2021, American companies imported $3.35 of goods from manufacturers in the world’s second-largest economy.

- U.S. mortgage rates continued to rise last week hitting 3.92%, a level not seen in nearly three years.

- Retail sales rose a seasonally adjusted 3.8% in January, showing that consumers spending habits aren’t being affected by higher prices for goods and services.

- The U.S. government ran a $119 billion surplus in January, breaking a streak of 27 consecutive months of deficits. The surplus was due to a sharp increase in tax receipts and less spending on Covid-19 pandemic aid programs.

|

Offices in Chicago, Kansas City, St. Louis, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors.