A strong jobs report on Friday did little to contain the selling in tech stocks last week. U.S. employers added 1.4 million jobs in August as the unemployment rate fell to 8.4% from 10.2%. That was in-line with analysts expectations.

According to people quoted in Saturday’s Wall Street Journal, Japan’s SoftBank Group Corp. had made a huge bet on several technology stocks earlier this year using a combination of stock and option purchases. SoftBank is a Japanese multinational conglomerate holding company owning technology, energy and financial companies.

Regulatory filings show Softbank bought nearly $4 billion of shares in tech giants such as Amazon.com Inc., Microsoft Corp., Tesla and Netflix Inc. among other technology stocks in the spring. Not included in those disclosures is the massive options trade, which is designed to pay off in a huge way if the stock market rises to a certain level. Options are contacts that allow investors to buy or sell shares at a specific price, at a future date.

According to traders, there have been mammoth options trades that include buying call options (a bullish bet) on several tech stocks like Amazon, Adobe Inc., Netflix, Facebook and Microsoft. Compounding the volatile price movements has been the advent of “free trading” for individual investors. As they see increased stock buying and options purchases they pile in exacerbating the price movement.

Softbank is best known for its $100 billion Vision Fund, which invests in tech startups like Uber, TikTok and Bytedance. Several months ago, Softbank was in the headlines for is huge investment in WeWork, an office leasing business with a unique strategy to attract millenial workers. However, inept management and extreme overleveraging brought on the demise of WeWork. Softbank still owns what’s left of the business, but ended up taking a $9 billion loss for their fiscal year ending last March.

The concern for investors this week is just how much a part did Softbank’s strategy play in the Nasdaq’s strong performance this year. And, how will it affect the market going forward? I’m sure we’ll hear much more about it this week. Be sure to check back here next week for the latest update.

I hope you and your family had a safe and happy Labor Day. During these trying times, it’s important to remember how fortunate we all are. If you have any questions, please let me know.

The Markets and Economy

- United Airlines announced it will permanently end flight-change fees for most domestic flights last Monday. The move is an effort to boost demand in an industry hard-hit by the pandemic. Less than 12 hours later, American and Delta announced they too were dropping fees for ticket changes. Ticket change fees have been a huge source of revenue for airlines. In 2019, U.S. airlines overall generated $2.8 billion in revenue.

- When compared to the size of the economy, U.S. debt hit its highest level since World War II. As bad as that may seem, it is expected to rise even higher next year.

- Fed officials are in agreement that more government support for the economy is needed. After the first wave of cash payments and enhanced unemployment benefits expired, Fed governors have expressed concern that partisan politics are preventing more financial assistance to Americans.

- Australia’s first recession in 29 years was confirmed last week when data showed the economy contracted a record 7% in the three months through June. It marked the longest-running growth streak in the developed world.

- The Economic Impact Payments of $1,200 per adult and $500 per child (under the age of 17) that were part of the 3/27/2020 CARES Act were the third time the government has issued direct stimulus payments in the last 20 years. The previous payments were made in 2001 and 2008.

- The median sales price of existing homes sold in the U.S. was $304,100 in July, 2020. That was the first time the median sales price exceeded $300,000

- cording to Procter & Gamble Co., consumer demand for paper towels is 25% higher than it was before the Covid-19 pandemic.

- Signs that Beijing’s efforts to stimulate consumption at home are having an impact. A gauge of Chinese business activity outside of manufacturing rose to its highest level in 2 1/2 years in August.

- U.S. manufacturing activity accelerated in August for the third consecutive month. The growth topped analysts estimates and was driven my new demand and faster export orders.

Offices in Chicago, Kansas City, St. Louis, Naples & Valparaiso.

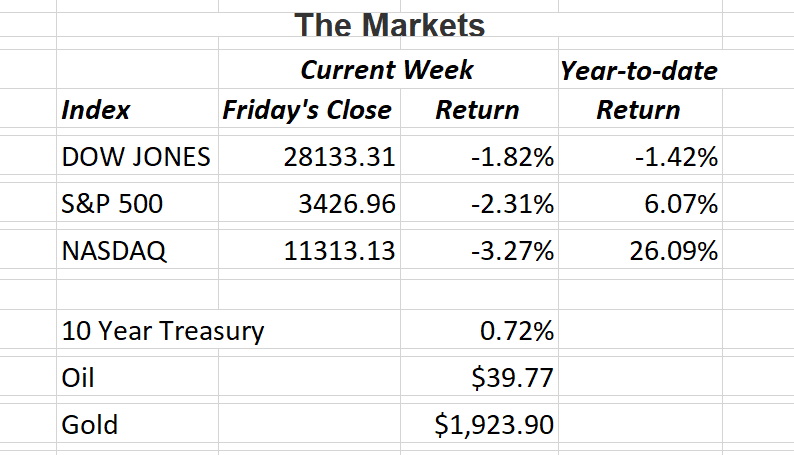

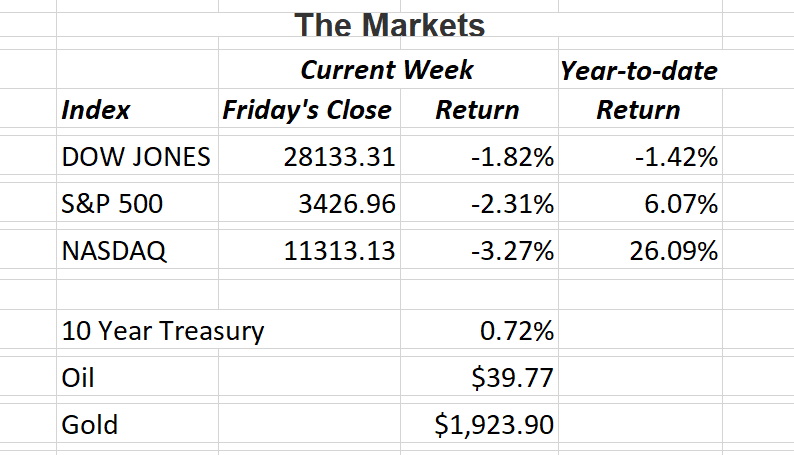

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Imvestment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors.