The stock market was closed for Good Friday when the job numbers were released. 236,000 new workers were added last month, a strong figure, but the smallest gain in more than two years. The official unemployment rate dropped slightly to 3.5% as more Americans jumped back into the labor market.

This puts the stock market and the U.S. economy at a nexus. The convergence of years of cheap money from the Fed’s policy of low interest rates, and an increase in the money in circulation. The latter was fueled by quantitative easing by the Fed and generous fiscal stimulus by our elected officials during the pandemic. This all set the stage for soaring inflation not seen in 40 years.

To combat rising prices, the Fed began an aggressive interest rate policy about 13 months ago. The gradual reduction in inflation seen so far is the result of the first interest rate hike. It typical takes about a year before the full effects are felt by the economy. We still have several more interest rate increases that have not yet been factored into the economy.

This puts the Fed in a precarious position that has been compounded by the challenges some regional banks are facing. Before Silicon Valley Bank and Signature Bank were taken over by the FDIC, it was expected the Fed would raise rates 0.5% in March. Due to the banking situation, an increase of only 0.25% was announced. We may still see one more rate increase in May when the central bank meets again. After that, analysts expect the Fed to hit the pause button.

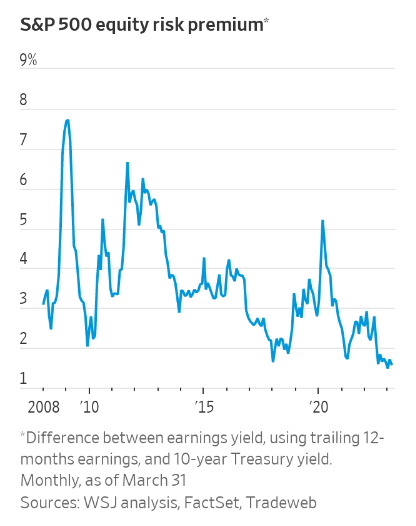

There is no shortage of analysts saying the stock market is overvalued and expect the S&P 500 to retest its lows set in October 2022. The chart below from the Wall Street Journal shows the gap between the S&P 500’s earnings yield and that of 10-year Treasuries sits around 1.59%. That low of a reading has not been seen since 2007. When the yield is this low, investors may prefer to own fixed income over stocks as the bond yields are much more attractive.

You would think with all of this bad news I would be bearish. I am not. I know the U.S. economy has some challenges ahead, but as I have been writing all along, I believe in the strength of our economy. There are too many factors to ignore.

In one example, construction spending related to manufacturing reached $108 billion last year – the highest annual total on record. The supply-chain issues many businesses faced due to the pandemic are being dealt with. Much of the growth is in high-tech fields such as electric vehicle batteries and semiconductors. Those are desirable high-paying jobs.

Many businesses have found that the cheapest producer is not always the best choice. When you factor in the challenges with shipping ports and dealing with uncertain foreign government policies, domestic production becomes attractive again.

First quarter earnings season is about to get under way. It will provide us with critical information on how companies and consumers are dealing with the effects of inflation on their business and wallets. I believe we will weather this storm and come out stronger.

If you have any questions, please contact me.

The Markets and Economy

- The IRS outlined its strategic plan for the $80 billion congress provided last year. An increase in staffing for customer call centers and major data upgrades are the main areas of focus for the government agency.

- Finland officially became the 31st member of the North Atlantic Treaty Organization (NATO). Sweden’s application to the organization is currently pending but is expected to be accepted.

- Vehicle transaction prices – the price you actually end up paying after any dealer discounts or markups – have been climbing higher and faster since 2020 than any other point in 35 years. This according to the Bureau of Labor Statistics.

- Oil prices shot up last week on the announcement from OPEC member Saudi Arabia that it would lead a cut in oil production among members. The 3.7% reduction in output was fueled by falling oil prices. Crude soared to $84.93 briefly on the news and closed the week at $80.70.

- The National Association of Unclaimed Property Administrators estimates that there is $70 billion in unclaimed assets across S. state treasuries. About 1 in 7 Americans have unclaimed assets that can range from dormant bank account balances to unclaimed life insurance benefits. To see if you have unclaimed assets, log onto missingmoney.com.

- Apartment building sales in the S. fell a whopping 74% in the first quarter of 2023. The $14 billion in first-quarter sales was the lowest amount for any quarter since 2021.

- Mortgage rates fell for the fourth consecutive week. A 30-year mortgage will cost a homebuyer 6.28% in interest. Last year they peaked at 7.08%. A year ago they were 4.72%.

Offices in Chicago, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This newsletter was prepared by David M. Kover®. To unsubscribe from the Weekly Market Update please write us at 555 Eastport Centre Dr., Suite B, Valparaiso, IN 46383 or click this link: Unsubscribe .

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors LLC, member FINRA/SIPC. Triad is separately owned and other entities and/or marketing names, products or services referenced here are independent of Triad Advisors LLC.

Investment advice offered through One Digital Investment Advisors, LLC, an SEC-registered investment adviser. One Digital Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors LLC.