U.S. stocks broke a four-week winning streak as investors digested information about the Fed’s policies regarding inflation. Investors had been feeling confident that inflation may have peaked this summer and the Fed would put their aggressive interest rate policy on hold. However, comments last week from the central bank along with released minutes from their July meeting puts aggressive interest rate increases back on the table for their September policy meeting.

Federal Reserve Bank of St. Louis President James Bullard said he would lean toward another 0.75% rate increase in September. After a 0.50% increase in March, the Fed raised rates by 0.75% in June and yet another 0.75% in July. While these increases seem large, remember that interest rates have been at historically low levels since the financial crisis of 2007-2008. Next week, central bankers will meet in Jackson Hole, Wyo. for the Federal Reserve Bank of Kansas City’s annual economic policy symposium. You can read about what the central bankers have to say in my weekly market commentary next week.

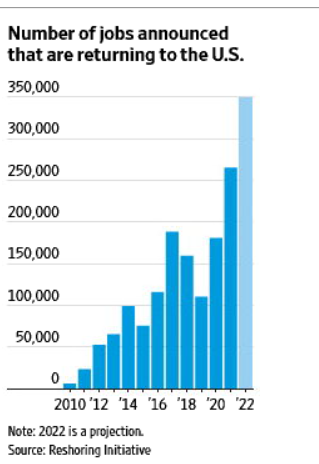

More good news on the jobs front. A Wall Street Journal article reported that U.S. companies are bringing workforces and supply chains home at a historic pace. American companies are on pace to return nearly 350,000 jobs this year according to Reshoring Initiative, a firm that tracks and encourages jobs returning to the U.S.

The Covid pandemic which severely disrupted global supply chains is the main reason. Corporations couldn’t get much needed parts due to their suppliers own issues overseas. Combined with the logjam at crucial U.S. ports, many companies now see a benefit to having a more reliable source for components.

The U.S. government is also luring companies back. The Chips and Sciences Act and the Inflation Reduction Act recently passed provide tax breaks and other incentives for building and investing in manufacturing centers for semiconductors, electric vehicles and pharmaceuticals. The chart below shows the dramatic increase in jobs returning to the U.S.

If you have any questions, please contact me.

The Markets and Economy

- Supply chains have yet to fully recover from the pandemic shock when goods transported by sea were delayed and shipping costs soared. Port congestion continues to plague global trade as retailers worry whether massive amounts of cargo will be delivered on time for the critical holiday shopping season.

- According to TV rating company Nielsen, Americans spent more of their July viewing time streaming content on services such as Netflix, YouTube, Hulu and HBO Max than they did watching cable television. This is the first time streaming has overtaken cable television for viewers.

- S. agricultural forecasters expect drought-struck farmers to walk away from more than 40% of the 12.5 million acres they sowed with cotton. This could end up being the weakest U.S. harvest in more than a decade. As a result, prices have risen sharply.

- Inflation in the K. hit 10% in July and will likely rise even higher through the remainder of 2022. Other parts of Europe have posted similar inflation numbers; the result of higher food and energy costs due to the war in Ukraine.

- Notes from the Fed’s July meeting were released last Wednesday. The central bank remains committed to rooting out inflation in the S. economy. However, the notes do show members discussed the risk of raising interest rates too much and cause damage to the fragile economy.

- Home sales in the S. fell for the sixth straight month, the longest streak of declines in more than eight years. The news is the latest sign the former booming housing market is stalling out.

- China’s economy, recovering from the “zero-tolerance” Covid policy, is struggling across all sectors. Hiring, consumer spending, factory output and real estate were all affected by the world’s second-largest economy seeing large cities shut down. The country’s central bank reduced interest rates to help spur economic activity.

Nationwide, school districts are dealing with what many administrators are calling the toughest teacher recruiting season they have ever experienced.

Offices in Chicago, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This newsletter was prepared by David M. Kover®. To unsubscribe from the Weekly Market Update please write us at 555 Eastport Centre Dr., Suite B, Valparaiso, IN 46383 or click this link: Unsubscribe .

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, LLC, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors, LLC.