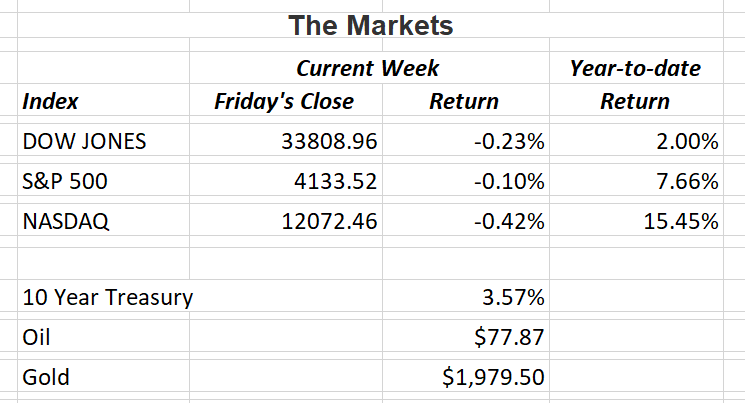

U.S. stock markets were slightly lower last week as investors poured over first quarter earnings for financial institutions. Results were mostly positive but there was still a price divergence between large banks and smaller regionals. The concerns for regional banks is how they will perform going forward in a more restrictive regulatory environment. Currently, smaller banks don’t face the same restrictions large money-center banks face. In light of recently failed Silicon Valley Bank and Signature Bank, that will likely change.

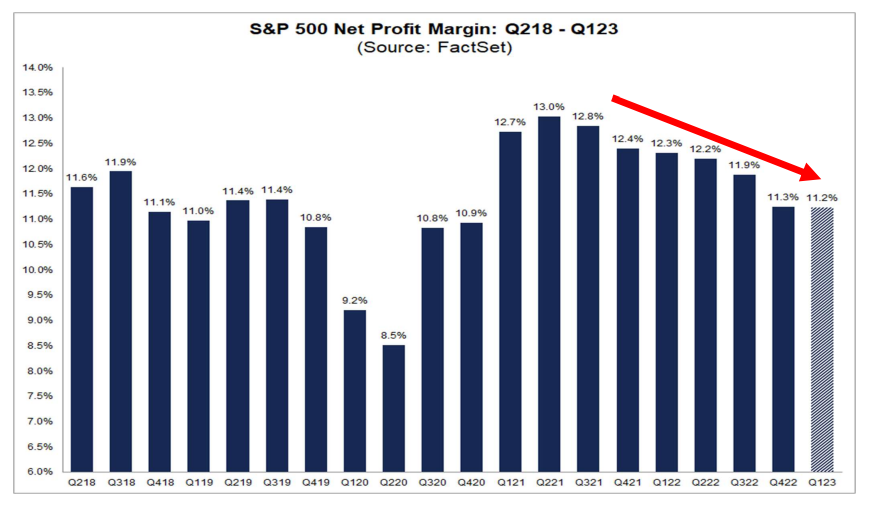

The strong showing for stocks in the first quarter of this year was a result of the leveling off of the profitability decline for S&P 500 companies (see chart below from FactSet). If we continue to see this figure stay flat or begin to increase, the market would definitely take that as a positive. This is why earnings are so important to the direction of stock prices. Unfortunately, there are other factors that directly affect company earnings.

One caveat: How the Fed’s interest rate policy as well as the continued reduction of their massive bond portfolio will affect markets in 2023 is still a guessing game. The chart below from FactSet shows the decline in stock prices last year was due to the reduction in profitability for S&P 500 companies. In last week’s market commentary, I showed the P/E ratio has pulled back to a more normalized range. This week’s chart shows another side to why the market was down last year.

Earnings season ramps up this week as large companies Microsoft, Amazon and Alphabet (Google) announce results. Investors will also keep a close eye on several economic reports. I’ll report on those next week.

If you have any questions, please contact me.

The Markets and Economy

- According to a recent survey by the National Federation of Independent Business, the percentage of small business owners who believe now is a good time to expand their business fell to its lowest level since March Hiring plans dropped to their lowest levels since May 2020.

- The Bull/Bear Ratio (BBR) climbed for the fourth week to 2.11. That’s the highest reading since January This ratio is considered to be a “contrarian” indicator. That means the lower it drops, the more positive stocks tend to be.

- The Old-Age, Survivors and Disability Insurance (OASDI) annual trustees report was issued at the end of March. The projected “exhaust date” for the Social Security Trust Fund was moved up a year to 2024 from 2035. At that point, annual revenues will only be sufficient to cover 80% of total benefits.

- After the failure of Silicon Valley Bank and Signature Bank, consumers are reporting tighter credit conditions. In a recent survey by the New York Fed, a record number of respondents (58.2%) reported that credit is now harder to get than a year ago.

- The U.K.’s rate of inflation was higher than expected in March and remained in the double digits. The 10.1% increase in consumer prices from a year ago means another interest rate increase from policy makers is likely.

- Procter & Gamble raised prices about 10% across its various brands in the first quarter of 2023. Consumers, it seems are absorbing those increases as earnings were up 10% year over.

- Home prices saw their largest decline in 11 years as sales fell in March. The beginning of the spring selling season saw sales drop 2.4% in March from the previous month. High mortgage rates, high prices and a lack of inventory are causing many potential home-buyers to sit on the sidelines.

- U.S. and European business activity rose in April at its fastest pace in over a year. While the welcomed news is good for equities, it is also raising concerns over stubbornly high inflation and global central banks efforts to battle it.

Offices in Chicago, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This newsletter was prepared by David M. Kover®. To unsubscribe from the Weekly Market Update please write us at 555 Eastport Centre Dr., Suite B, Valparaiso, IN 46383 or click this link: Unsubscribe .

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors LLC, member FINRA/SIPC. Triad is separately owned and other entities and/or marketing names, products or services referenced here are independent of Triad Advisors LLC.

Investment advice offered through One Digital Investment Advisors, LLC, an SEC-registered investment adviser. One Digital Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors LLC.