The U.S. isn’t the only nation experiencing higher interest rates due to inflation. It seems higher prices are also affecting neighboring countries as well as our friends across the Atlantic. Just last week, the Bank of Canada raised interest rates by 0.75% and the European Central Bank said it would also increase interest rates by 0.75%. Our own central bank is expected to raise interest rates by 0.75% at their next policy meeting on September 21.

After surprising the markets with his hawkish warnings that the Fed’s actions may “bring some pain” a few weeks ago at the Jackson Hole summit, the chairman reiterated that the central bank, “…needs to act now forthrightly, strongly, as we have been doing…” This means investors are pretty convinced we will see a third consecutive 0.75% rate increase in a couple of weeks. If this happens, it will bring the benchmark federal funds rate from near zero in March to a range of 3.0% – 3.25%.

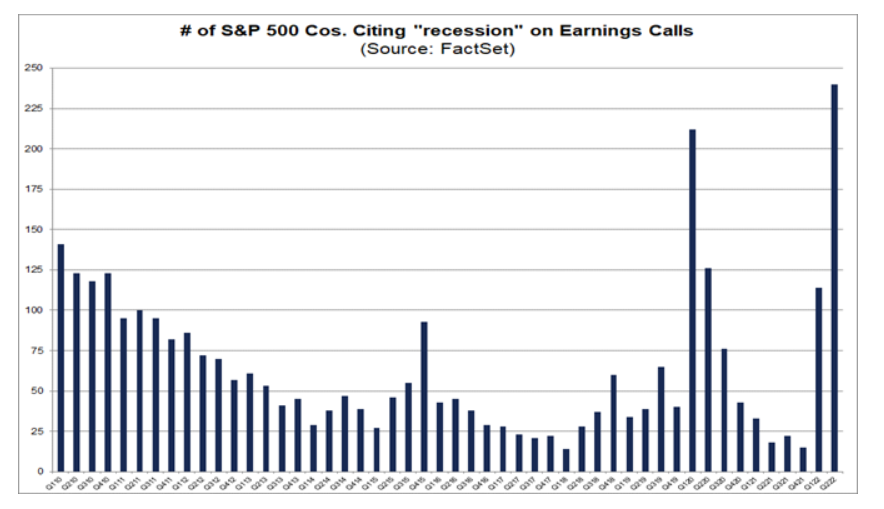

The result of the Fed’s actions is causing some worry in the business community according to FactSet. 240 companies in the S&P 500 have cited recessionary concerns in their analyst’s calls over the last few months. This is the highest number going back to 2010. The chart below from FactSet puts it into perspective. Look at the bar on the far right of the chart.

Now the good news! Chairman Powell did not rule out a scenario where the Fed can engineer a soft landing for the U.S. economy. In fact, Powell believes that by acting more swiftly with purpose, the central bank might avoid the runaway inflation experienced in the 1980″s. The stock market obviously took that to heart as the Dow Jones Industrial Average posted a gain of 2.6% while the S&P 500 gained 3.6%. The tech-heavy Nasdaq gained over 4%.

If you have any questions, please contact me.

If you have any questions, please contact me.

The Markets and Economy

- Mortgage rates in the S. hit their highest level in 14 years. The cost of a 30-year fixed-rate mortgage hit 5.89% last week.

- Liz Truss won the race to lead the conservative party and became Britain’s next prime minister. She faces an economic storm created by the pandemic, brexit and the war in Ukraine. The country is on track to record the lowest economic growth and highest inflation in the Group of Seven large nations.

- Chinareported their Consumer Price Index rose 2.5% and the Producer Price Index rose 2.3% in August. Both figures were lower than analysts expected. The world’s second largest economy has been besieged by droughts, a massive overbuilding in the housing sector and economic turmoil caused by Beijing’s zero-Covid policy.

- The world’s second largest movie theater chain filed for bankruptcy last week. Cinemark, who operates 800 movie houses around the globe, has $5 billion in debt and is facing another $1 billion legal judgement stemming from a soured merger with Canadian cinema chain, Cineplex. Movie theaters have been struggling to bring audiences back after the pandemic.

- The European Commission projects inflation in the Eurozone will hit 7.6% in 2022. That’s up from their previous projection of 6.1% a few months ago.

- Americans love their “nice” cars. Sales of luxury vehicles have risen over 17% so far in 2022.

Offices in Chicago, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This newsletter was prepared by David M. Kover®. To unsubscribe from the Weekly Market Update please write us at 555 Eastport Centre Dr., Suite B, Valparaiso, IN 46383 or click this link: Unsubscribe .

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, LLC, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors, LLC.