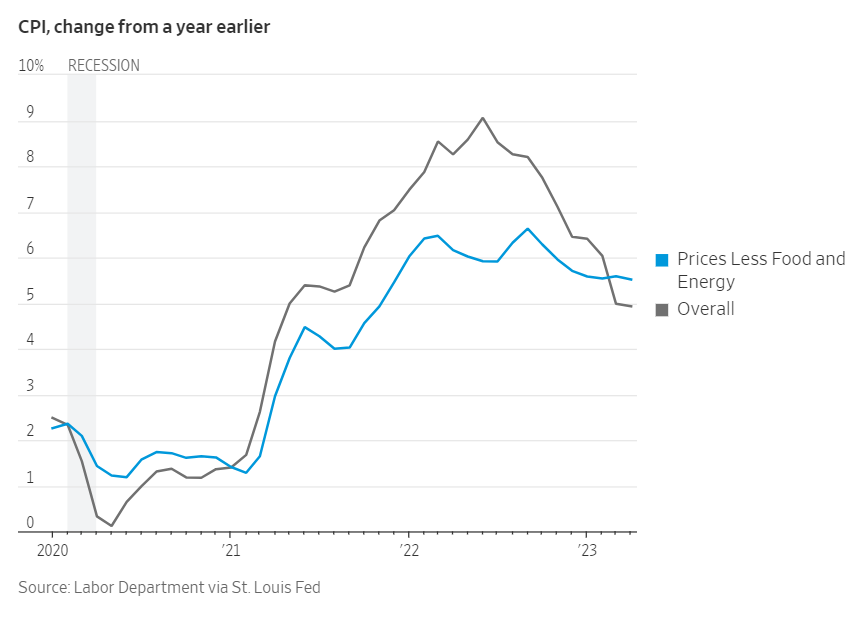

Markets were mixed last week as inflation cooled in April for the 10th consecutive month. The Consumer Price Index (CPI) continued its drop from a peak of 9% last summer. The 4.9%, while still stubbornly high, continues to move in the right direction. Also, the Producer Price Index (PPI) dropped to a reading of 2.3%, down from March’s 2.7%. It just needs to drop faster according to the Fed.

The chart below from the Labor Department shows how much inflation at the consumer level has receded since hitting a peak last summer. It also shows how much further it has to go before the Fed feels comfortable about it. I believe another 0.25% rate increase at the central bank’s June meeting is a strong possibility.

It’s an interesting conundrum: The good news is, the economy is strong but the bad news is, the economy is strong. In light of all of this, it’s important to note that workers are the happiest they’ve been in 36 years. Wages and work flexibility are improving significantly. 62.3% of working Americans said they are satisfied with their jobs according to new data from the Conference Board. In spite of concerns about a possible recession, people are happy to be over the supply chain shortages and pandemic fears. Jobs are still plentiful for those looking.

If you have any questions, please contact me.

The Markets and Economy

- According to the National Association of Realtors, home prices fell in more parts of the U.S. in the first quarter than they have in over a decade. The report went on to say that home prices were lower in expensive markets and higher in affordable areas.

- The popularity of Artificial Intelligence (AI) chatbots is evidenced by ChatGPT reaching 100 million users in two months, the fastest on record. It took Tik-Tok nine months to reach that threshold and 30 months for Instagram.

- Americans increasingly believe the benefits of a college education may not be worth the cost. Ten years ago, 40% said college wasn’t worth the cost. Now, that number has jumped to 56%.

- At the annual Berkshire Hathaway shareholder meeting, 92 year-old Warren Buffett took the center stage to talk to investors. He said: “What gives you opportunities is other people doing dumb things. In the 58 years we’ve been running Berkshire, I’d say there’s been a great increase in the number of people doing dumb things.” Buffett has been singing the praises of Apple as well as major oil producers. In other comments, Buffett leveled blame for the regional banking problems at the chief executives and board of directors.

- Western companies are looking for alternatives to China for factory production. They are frequently finding an answer in neighboring India. With a labor force and market potential similar to China, India is quickly becoming a viable option. In recent years, India has also worked hard to become more business friendly than in the past

- Homeowners looking to buy up are finding themselves in a strange situation. sticker shock over mortgage rates. After decades of declining interest rates, homebuyers are faced with current mortgage rates of about 6.4%. According to mortgage data firm, Black Knight, about two-thirds of primary mortgages are below 4%.

- The Organization of Petroleum Exporting Countries (OPEC) reported oil production fell 191,000 barrels in April due to production problems in Nigeria and a legal dispute in Iraq.

Offices in Chicago, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This newsletter was prepared by David M. Kover®. To unsubscribe from the Weekly Market Update please write us at 555 Eastport Centre Dr., Suite B, Valparaiso, IN 46383 or click this link: Unsubscribe .

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors LLC, member FINRA/SIPC. Triad is separately owned and other entities and/or marketing names, products or services referenced here are independent of Triad Advisors LLC.

Investment advice offered through One Digital Investment Advisors, LLC, an SEC-registered investment adviser. One Digital Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors LLC.