The Markets and Economy

- A recent Nationwide Retirement Institute study found that the Covid-19 pandemic and the 2007-2008 financial crisis events have shaped how women think about their finances. The study found that women tend to make better long-term decisions than men during financial crisis.

- President Biden banned the import of oil and other energy sources from Russia last week. The move is to further punish Moscow for its invasion of Ukraine.

- 12% of the world’s wheat exports and 16% of the world’s corn exports come from Ukraine according to the Department of Agriculture.

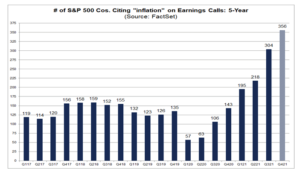

- Inflation in the U.S. continued to advance as prices hit another 40-year high, rising 7.9% last month.

- Worldwide deaths from Covid-19 are at approximately 6 million. Here in the U.S. almost 1 million have died.

- 47.4 million Americans quit their full-time jobs in 2021, the highest annual number recorded in the U.S. based on data tracked since 2001.

- The number of self-employed people in the U.S. soared to 10 million in February, 400,000 more than when the pandemic began. The shift comes with risks and rewards as the joys of reduced working hours can be offset with the uncertainty of a steady paycheck and savings being eroded by higher inflation.

- 49% of the 639 small business owners surveyed in December 2021 report they have job openings that they are unable to fill.

|

Offices in Chicago, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors.