U.S. stock indexes have posted negative returns four of the last five weeks. Last week Investors got a double-whammy hit of inflation fears and corporate profit warnings. Below is an update on what is happening in the markets and why.

- Inflation fears. Consumer prices rose a stronger-than-expected3% in August compared to the same month a year ago. Inflation is slightly lower than the 9.1% posted in June and 8.5% posted in July. However, with prices continuing to run stubbornly high, it makes it more likely the Fed will raise interest rates by yet another 0.75% on Wednesday, this week. Analysts had hoped that falling energy prices would be enough to see a significant decrease in inflation for consumers, but that didn’t happen. Inflation is also staying high at the producer level which measures what suppliers are charging businesses and other customers. On an annual basis, the Producer Price Index is 8.7% higher in August than a year earlier. While that is down from 11.2% in June and 9.8% in July, it is still much higher than it should be. All of this means no one is sure what the Fed might do at their November meeting. Another 0.75% increase can’t be ruled out if we continue to see prices stay at high levels.

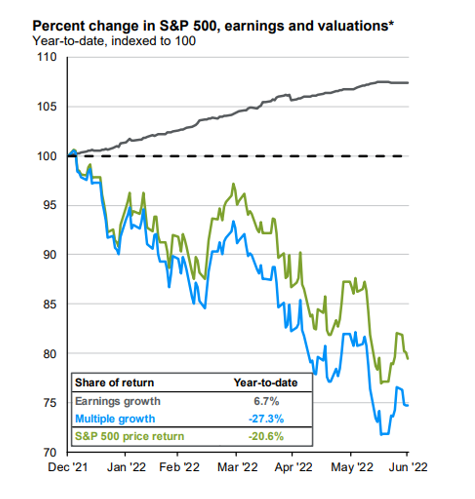

- Corporate profit fears. We all know that corporate profits are what drives the market. The chart below from Ladenburg shows an interesting divergence between profits and stock prices. The dark solid line above the dotted-line represents the earnings for the S&P 500. This year, it is estimated earnings will grow by about 10%. The green line is the price return for the S&P 500 through June. This means we are seeing rising corporate profits with declining stock prices. That doesn’t happen often but it tells us that the days of strong earnings growth may be ending soon. That doesn’t mean profits will fall off a cliff like they did in 2008, but we may see them decline slightly. The blue line is the multiple of earnings growth. I won’t bore you with that definition this week but it has declined too.

If you have any questions, please contact me.

The Markets and Economy

- Americans borrowed a record $1.61 trillion from mortgage lenders in 2021. That breaks the previous record of $1.51 trillion set in 2005. Surprisingly, this figure does not include refinanced homes.

- Mortgage rates rose above 6%, the highest since 2008.

- Consumers pulled a record $370 billion from banks in the second quarter. The outflow isn’t a problem for banks as they still have more deposits than they want; a side effect of lower loan demand due to higher interest rates. Those higher rates are also causing consumers to look at other sources to maximize their interest earning potential.

- You think we’re dealing with high prices? Consumer inflation in Turkey is up 78.6% on a one-year basis according to the Turkish Statistical Institute.

- Next month, the Social Security Administration will announce the cost-of-living increase for 2023. According to data up to this point, it will most likely be the largest increase in 40 years. Having said that, those of us on Medicare will likely see some kind of offset with increased health care costs.

- In an effort to deal with skyrocketing energy prices and a slowing economy, the European Unionoutlined a plan to help consumers and small businesses. A redistribution of $140 billion from energy companies is being proposed. The EU believes the windfall profits and revenue that energy sector companies are benefitting from should be used to help lessen the financial burden of those affected.

With both sides claiming they won concessions, an economically disastrous strike was averted in the railroad industry. A federal panel assisted in the contract negotiations as railway workers have been working without a contract since 2019. The five-year deal includes pay increases of 24%, partially retroactive to 2019.