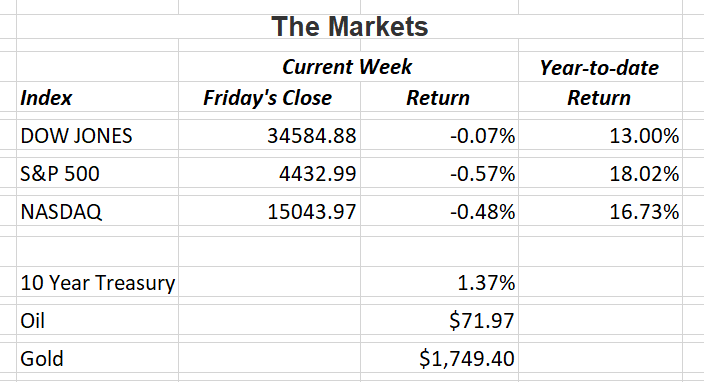

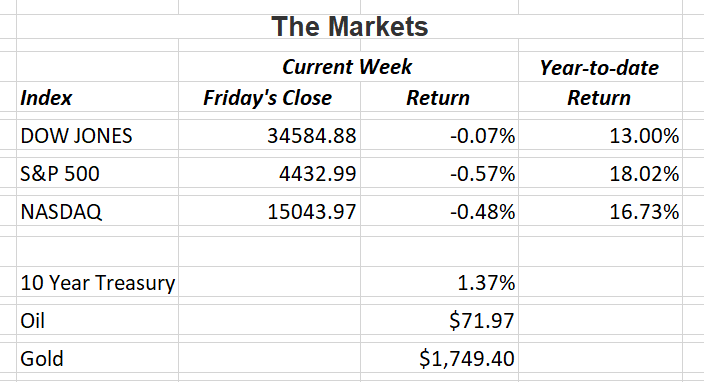

Investors continued to grapple with mixed economic data last week as major indexes moved slightly lower. Inflation, the Delta variant and continued challenges in the supply-chain delivery times are all making investors nervous. In a few weeks, they will have something else to be concerned about; third quarter corporate earnings. We will keep you updated as reports come in around the second week of October.

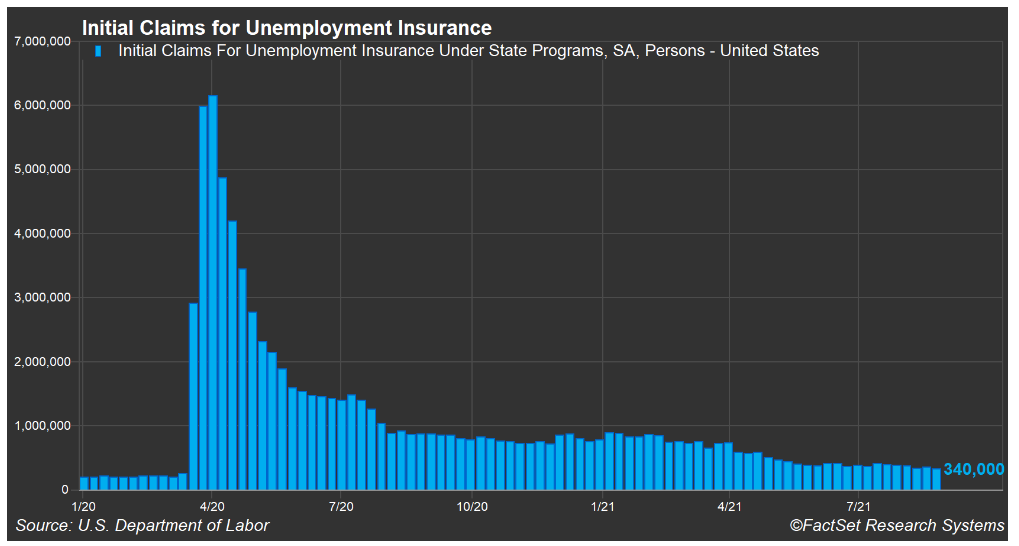

Last week we looked at GDP growth and food prices. The third chart on our list is for Initial Claims for Unemployment. We want to see these numbers continue to drop for a continued strong rebounding economy. Equally important, we want to see more people going back to work. August figures were a disappointment as non-farm payrolls increased by a scant 235,000. Analysts had expected 750,000 new jobs.

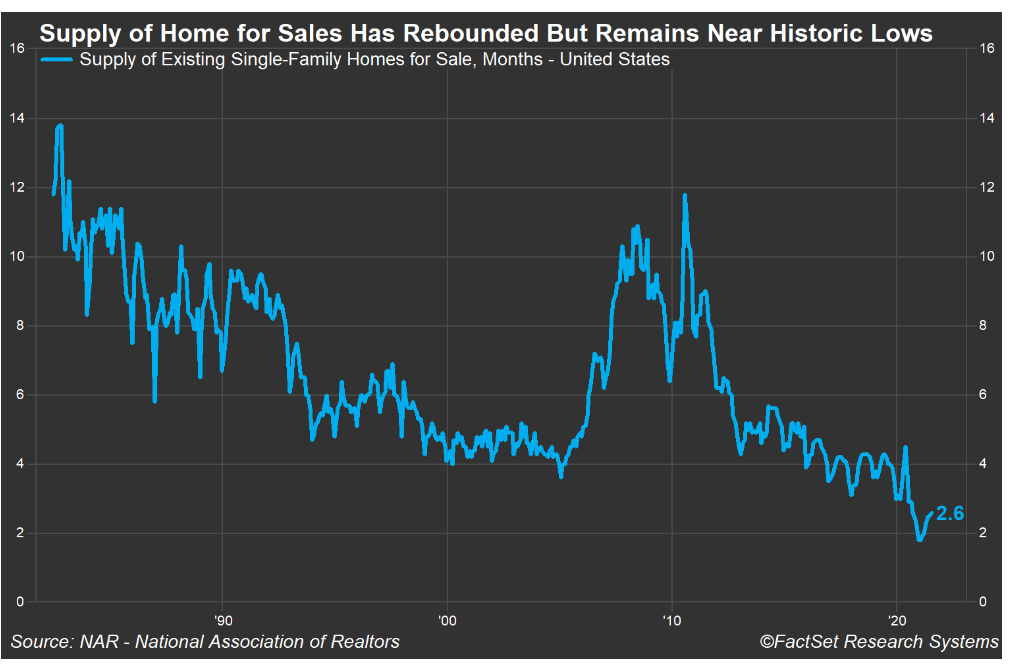

The fourth chart below shows why home prices continue to skyrocket. There just isn’t enough inventory available for prices to find some kind of equilibrium. As long as there is a shortage of homes for sale, prices will continue to rise. Demand is definitely in control.

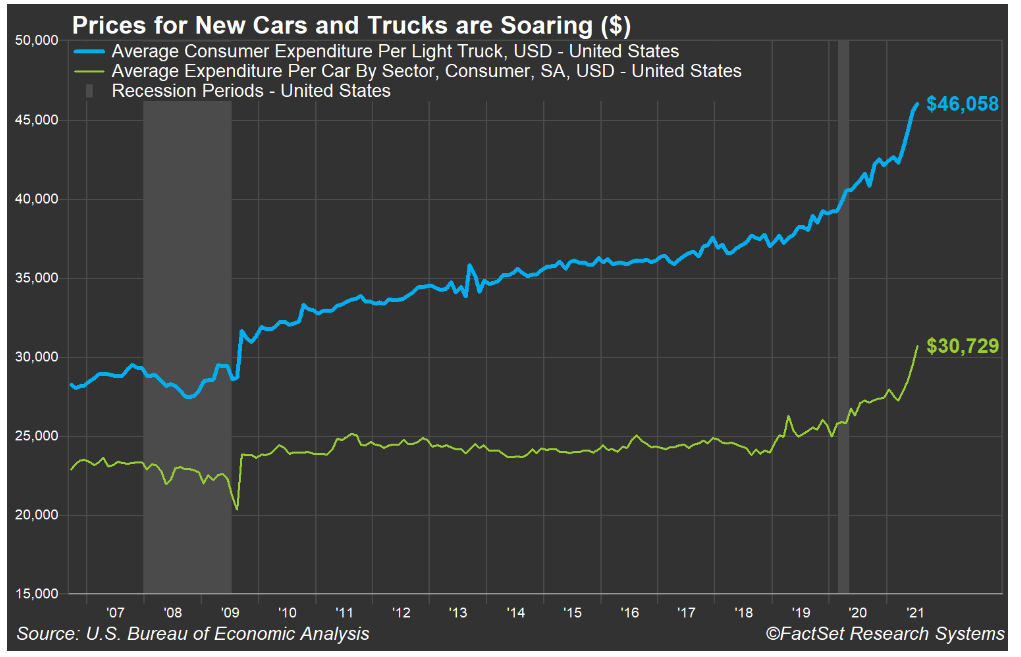

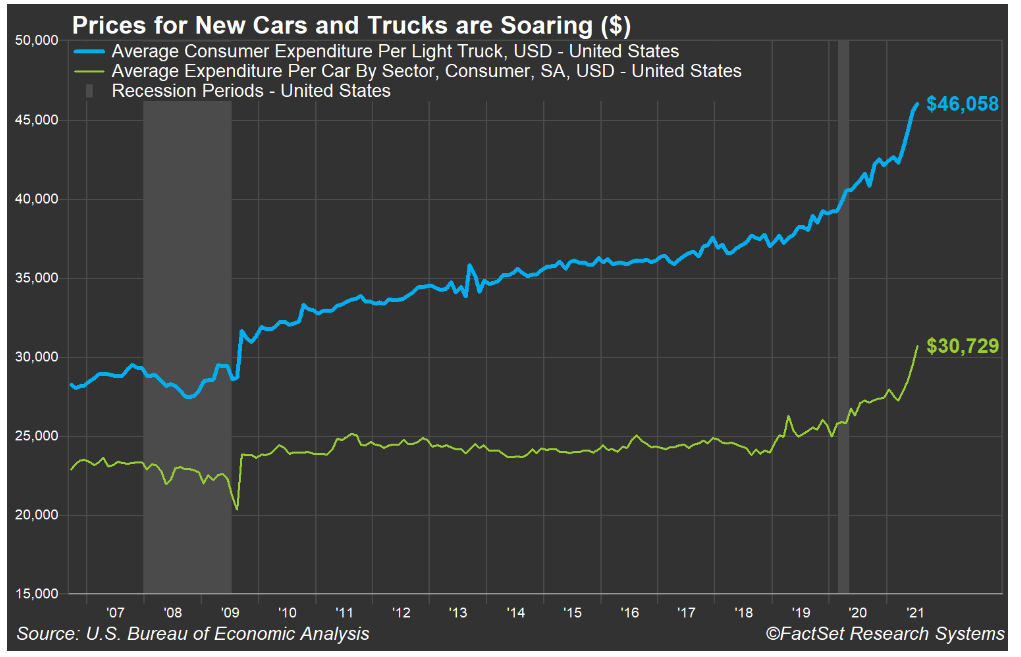

The last chart we will be keeping a close eye on for the remainder of the year is the price for new cars and trucks. The green line is for the average price for a new car and the blue line is for the average price of new trucks. The shortage of computer chips is having a disastrous effect on new vehicle sales. Unfortunately, the lack of supply of those chips is causing car manufacturers to shut down production and close factories. With a dwindling supply of new vehicles for sale, prices will obviously continue to rise; just as it is with housing prices.

We will continue to watch the development of these charts and other economic data as we move through the final quarter of 2021. If you have any questions, please contact me.

|

The Markets and Economy

- OPEC expects demand for oil to surge next year. The increase of about an additional 1 million barrels a day in demand is expected as the world recovers from the effects of the pandemic. If this estimate holds true, it will put demand for 2022 above 2019’s usage.

- At least 500 U.S. companies have filed for bankruptcy protection per year since 2015. In 2020, that figure grew to 630. So far in the first half of 2021, 242 companies have filed for bankruptcy protection.

- Inflation cooled slightly in August but still remains strong. The Labor Dept. said last month’s consumer-price index rose a seasonally adjusted 0.3% from July’s increase of 0.5%.

- Amazon.com Inc. announced it plans to hire 125,000 employees at 100 facilities across the country. The tech giant said starting wages will average $18.32 an hour.

- Industrial production in the U.S. slowed to a 0.4% gain in August. Refineries and plants along the Gulf Coast faced shutdowns due to Hurricane Ida.

Offices in Chicago, Kansas City, St. Louis, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors.

|