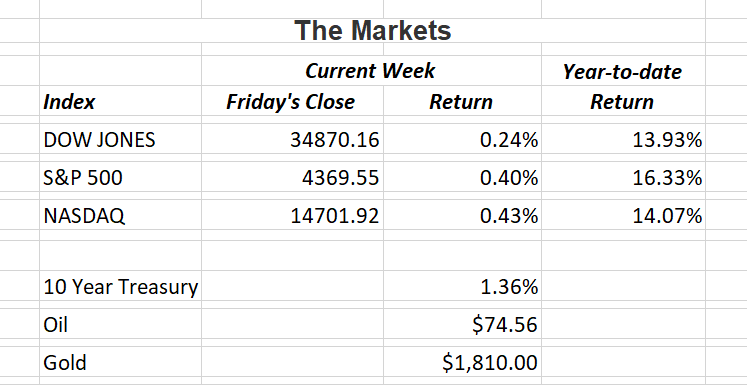

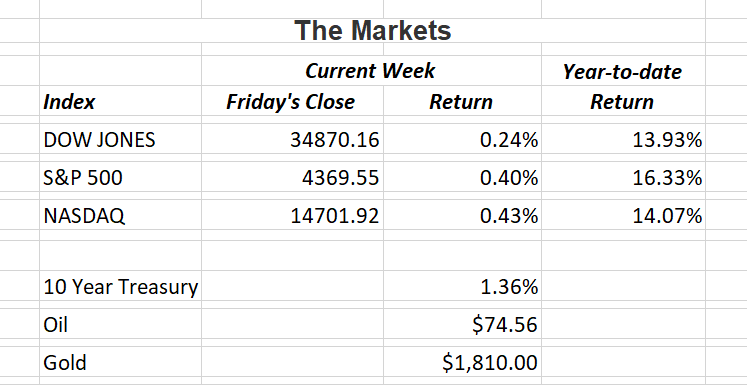

After a rocky start to the post Fourth of July trading week, equity markets staged a strong rebound to close at new record highs. It seems when the stock market experiences any type of pullback, investors step in to add to their positions pushing indexes back to new highs. How can the economy and stock market rebound as strongly as they have with payrolls still short about 7 million jobs from where it was before the pandemic hit. And oh, by the way, second quarter earnings begin this week too.

There was an interesting article this weekend in the Wall Street Journal about the challenges the jobs market faces. I’ve summarized the main points below.

As of May 2021, nine million Americans said they wanted jobs but couldn’t find one. Companies said they had over nine million jobs available that weren’t filled, a record high. Why the disconnect?

America’s complicated recovery is dealing with several paradigm shifts. Many workers have moved from an urban setting to the suburbs or more rural areas. This makes it difficult for restaurants and other service-oriented businesses located outside the city as they struggle with the increase in demand but a shortage of workers. Those same businesses in the city are still struggling to survive. They have the workers but not the business.

Many workers have left their industry altogether. A recent ZipRecruiter survey found that 70% of workers in the leisure and hospitality industry are now seeking employment in a different industry. Economists call this a “mismatch” between jobs open and the people looking for work. This happened in 2008-2009 when workers in construction, manufacturing and real estate struggled to find employment after the housing bubble.

Economists also note a “skills mismatch” currently exists in the economy. Workers’ experience doesn’t match up with skills needed for available jobs. While Amazon may need more warehouse workers and drivers, people’s work experience may not fit with what the world’s largest online retailer is looking for. Dealing with the Covid pandemic has created this problem.

In an effort to deal with this situation, employers are paying more to attract the workers they need. Economists find it strange that even with wages rising briskly, the unemployment rate is still at a high reading of 5.9%. With workers earning more and jobs plentiful, unemployment should be dropping rapidly but it isn’t. A result of “mismatch.”

The additional federal jobless benefits being paid may also be a reason why some workers are not in a hurry to get back to work. That may change as 24 states have said they will end supplemental unemployment benefits in June or July. Hopefully, the U.S. economy will continue to grow and more Americans rejoin the workforce. I’ll report here next week how second quarter earnings are shaping up.

If you have any questions, please contact me.

The Markets and Economy

- Materials shortage continues to plague the economic recovery. Supply-chain bottlenecks are creating a shortage of goods such as cars and major appliances and creating what the Fed calls “transitory” inflation.

- The computer chip shortage affecting the auto industry is hitting China as well. Passenger car sales in the world’s second-largest economy dropped 5.1% in June.

- Coal usage is surging in some of the world’s largest economies as electricity demand rebounds from the pandemic. This highlights the challenges for countries to wean themselves off the dirty but reliable fossil fuel.

- As second-quarter earnings season gets under way, analysts expect S&P 500 year-over growth to be the highest in more than 10 years. While this is great news remember last year at this time, earnings were down about 40%.

- As Americans rush back to airports more quickly than airlines have anticipated, delays, cancellations and long wait-times are on the rise. Bad weather has also compounded the problem as the U.S. deals with sweltering heat in the west and torrential rain and hurricanes in the east.

- A growing divide is emerging on Wall Street. Some firms such as JPMorgan Chase & Co. and Goldman Sachs Group, Inc. are calling for workers to return to the office while others like Citigroup Inc. are touting more flexible work schedules that include working from home.

- Supermarkets are stocking up on goods in anticipation of higher food costs. A year ago consumers were stockpiling goods. Now, grocers are. Interesting.

- U.S. investors continue to pour money into the stock market. In June alone, investors bought almost $28 billion in stocks and ETF’s.

Offices in Chicago, Kansas City, St. Louis, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors.