The Markets and Economy

- According to U-Haul, the three most popular states to move to in 2021 were Texas, Florida and Tennessee. The three states with the greatest outflow last year were California, Illinois and Pennsylvania.

- The Omicron variant is having an impact on manufacturing and service businesses in the U.S. A key index that measures activity in both manufacturing and services sector fell to an 18-month low of 50.8 in January from December’s reading of 57. A reading above 50 shows activity is increasing. However, analysts are concerned how long the economic impact from the Omicron variant will negatively impact our recovery.

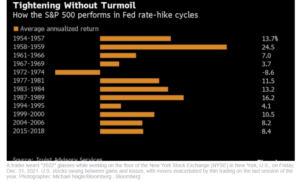

- Federal Reserve officials are set to resume talks on how they will continue to shrink the central banks $9 trillion bond portfolio when the time is right. Doing so will serve as a tool for tightening monetary policy in an effort to tame inflation.

- The Fed stayed the course last week with no change to interest rates. A majority of economists expect the Fed to raise interest rates by at least 0.25% at their March meeting.

- The price of new vehicles in the U.S. increased 11.8% in 2021. That may seem like a lot, but it pales in comparison to the 37.3% increase in prices for used cars and trucks.

- U.S. commercial property sales posted record results in 2021. Warehouses and apartment buildings benefitted the most as investors believe the pandemic is creating a paradigm shift in the way Americans live, work and play.

- Wages grew at their fastest pace in 21 years as employers struggled to find workers. On average, U.S. employers spent 4% more on wages and benefits in 2021.

- The spread of the Omicron variant and rising inflation kept household spending subdued. Consumer spending declined by 0.6% in December from the previous month.

Offices in Chicago, Kansas City, St. Louis, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors.