Will they or won’t they? That was one of the questions markets focused on last week. Of course I’m talking about the stall in Washington over the debt ceiling. The only thing both sides of the aisle have in common is their emphatic stance that a default will be averted. How that will be accomplished when both parties are so far apart is anyone’s guess. We were in a similar situation in 2011. Back then, an agreement was reached two days before the deadline with a complex set of guidelines. A default was averted and of course, in trule political fashion, both sides claimed victory. Let’s hope it doesn’t go that far down to the wire this time.

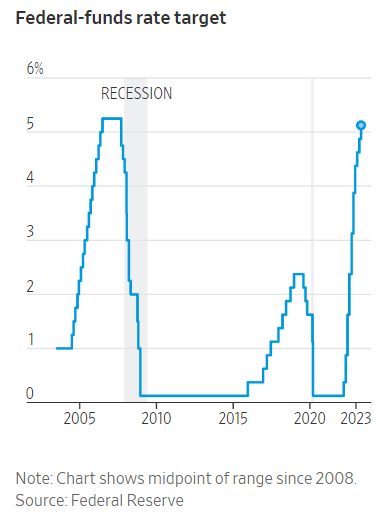

The other question Investors and economists were asking themselves last week regards the Fed. How much is enough? The central bank has raised interest rates ten times since inflation reared its ugly head back at the beginning of 2022. In that time, the target for the federal funds rate has gone from 0 to 5% (see chart below). It hasn’t been this high since before the financial crisis hit in 2007. That was followed by a nasty recession. However, there’s good reason to believe this time may be different.

Retail sales are strong. Hiring remains robust and corporate profits have come in stronger than expected. Over 77% of S&P 500 companies reporting results have beaten analyst’s estimates.

That’s all good news for the stock market, but there are a few dark clouds on the horizon. Nearly half of all U.S. banks have tightened their lending standards according to the U.S. Federal Reserve Bank. Not only are they tightening their requirements, they are charging higher rates on new loans due to the Fed’s policy of raising interest rates. That makes borrowing more costly. The key is slowing the economy enough to continue to bring inflation down, but not throw the U.S. into a recession. They call that a “soft landing” and is still the goal of the Fed.

The Fed meets next on June 13-14. The signals coming out have been mixed. Chairman Jerome Powell said last week that the stress in the banking system could mean that the central bank won’t have to raise interest rates as high as it normally would to slow the economy. We’ll see.

If you have any questions, please contact me.

The Markets and Economy

- For the second month in a row, S. small-business owners who expect to expand their business over the next 12 months fell below 50%. That’s the lowest level since June 2020 when the effects of the pandemic were being felt.

- Sales of existing homes in theS. fell 3.4% in April from the previous month and were down 23.2% from a year earlier. Meanwhile, the national median existing-home price fell 1.7% from a year earlier. That was the largest year-over price decline since January 2012 according to the National Association of Realtors.

- During the first quarter of 2023, total S. household debt hit a record high of $17.05 trillion. The majority of increase came from the categories of home mortgages, equity lines of credit, auto loans, student loans and retail credit. Credit card balances, however, were flat.

- The Biden administration is considering creating a government-run alternative to TurboTax and H&R Block. Consumer advocates have been pushing for the Internal Revenue Service to offer free online tax filing, especially for people with straight-forward simple returns. Companies feel that the government has no place competing for their business, and some politicians believe the IRS has enough trouble handling their own department.

- After surging 545% from April 2020 to May 2021, lumber futures have plummeted 80%. They are now 25% below pre-Covid prices of February

- Nearly half of all Americans do not have a retirement account. Relying solely on Social Security could present a problem. The average monthly Social Security check for a retired worker is $1,800. However, the average household for people 65 or older spends $4,000 a month on living expenses.

- Americans boosted their retail spending for the first time in months. The latest figures, a 0.4% increase, point to signs of resilient consumers battling high inflation.

- China’s demand for oil is growing rapidly. The International Energy Agency raised its forecast for global oil demand this year by 200,000 barrels a day to 2.2 million. China’s energy needs are expected to make up a large amount of that increase.

Offices in Chicago, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This newsletter was prepared by David M. Kover®. To unsubscribe from the Weekly Market Update please write us at 555 Eastport Centre Dr., Suite B, Valparaiso, IN 46383 or click this link: Unsubscribe .

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors LLC, member FINRA/SIPC. Triad is separately owned and other entities and/or marketing names, products or services referenced here are independent of Triad Advisors LLC.

Investment advice offered through One Digital Investment Advisors, LLC, an SEC-registered investment adviser. One Digital Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors LLC.