U.S. stock markets extended their rally for a second consecutive month. The S&P 500 and Dow Jones Industrial Average both climbed more than 4% in May, building on April’s robust rebound. The reason for the strong performance in domestic stocks appears to be tied to evidence that the U.S. economy may have bottomed. Below are a few of the positive points investors and analysts are looking at:

The number of workers receiving unemployment benefits fell for the first time since February. The Labor Department said that while the numbers have fallen, the level of claims is still 10 times pre-pandemic levels.

With fewer workers on unemployment rolls economist believe the U.S. labor market is at an inflection point where new layoffs are largely offset by hiring as workers are being called back to their jobs.

U.S. consumer spending fell a record 13.6% in April during the lockdown. But there are signs purchasing is starting to pick up as states start to reopen for business and Americans return to work.

Consumer sentiment is beginning to increase. The University of Michigan’s closely watched survey showed a slight increase in consumers’ outlook in May from April.

Travel for the Memorial Day weekend was strong. Hotels reported stronger than expected occupancy and recreational locations were busy.

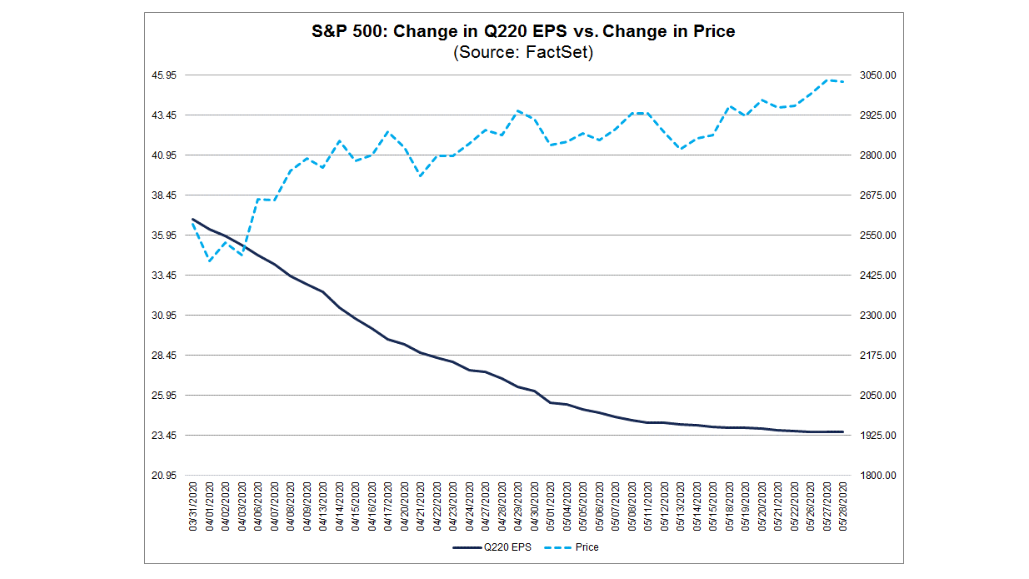

The chart below from FactSet shows the decline in earnings-per-share (bottom line) leveling off, and the climb in stock prices (top line).

While the stock market may have rebounded stronger than anticipated, hope is building that the U.S. economy is beginning to regain momentum.

The Markets and Economy

- American shale drillers helped turn the U.S. into the world’s top oil producer, topping 13 million barrels a day. It likely will be years before they reach such heights again. Many shale drillers are on the brink of bankruptcy.

- According to Fidelity National Information Services Inc. (FIS) there has been a big jump in attempted credit and debit card fraud since the coronavirus shut down the U.S. economy earlier this year. FIS assists approximately 3,200 banks in the U.S. with fraud monitoring.

- Hong Kong has operated as one of the freest economies in the world, even in the 23 years since Britain returned control over to China. That changed last week when Beijing announced it plans to impose greater control over Hong Kong’s affairs. A 1992 law requires the U.S. State Department to assess the extent of the former British territory’s autonomy from China.

- A sharp spike in lumber prices is fueling hope for a rebound in the housing sector. At a recent virtual conference, JP Morgan Chase & Co. said the drop in demand for new homes has not been as bad as originally expected.

- Hotel occupancy rates across the country have risen for five straight weeks. The hospitality sector is one of the most important for the U.S. economy. Hopes that a bottom for travel has been seen and the climb upward will continue to grow.

- Walt Disney Co. said it plans to reopen its Orlando Disney World theme park at reduced capacity in mid-July.

- Pending home sales fell nearly 34% from a year earlier in April, the biggest annual decline on record. Real-estate brokers and analysts believe things will bottom in May and expect the housing boom to resume this summer.

- Analysts are worried that today’s economic challenges could plague states and local municipalities for years to come. Local government spending and employment levels didn’t fully recover from the 2007-2009 recession until last fall, a decade after the downturn ended.