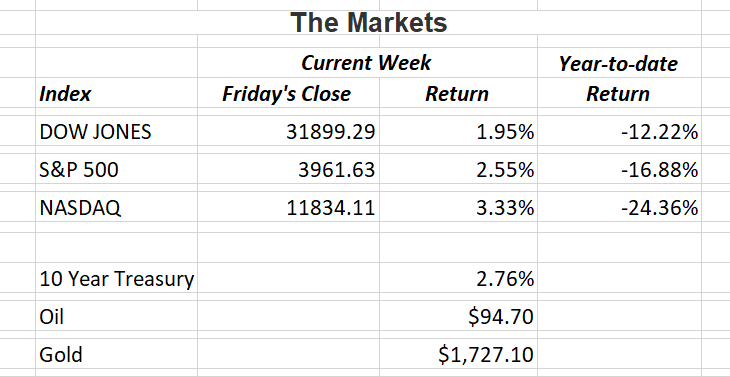

Major U.S. stock indexes rallied last week on strong earnings reports. The upswing in stocks has some analysts saying we may have seen the bottom in equity prices. Trying to predict the bottom is just as dangerous as trying to pick a market top. It’s an exercise in frustration that typically never ends well. Having said that, I did read an interesting survey from Merrill Lynch’s parent company, Bank of America that I wanted to share.

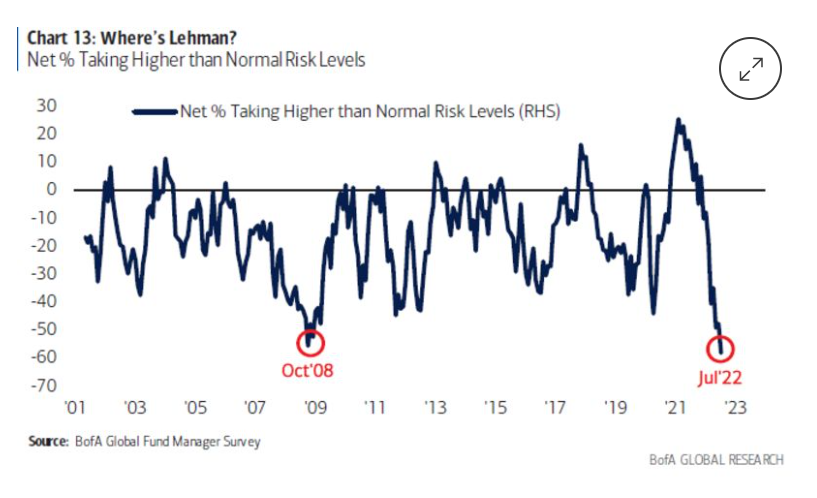

The survey included 259 money managers with a total of $722 billion in assets under management. One of the findings highlights this year’s flight from riskier assets during the first half of 2022. As investors dumped stocks, U.S. indices saw their worst six-months performance since 2008. The chart below shows just how much risk-averse investor have become compared to the financial crisis of 2008.

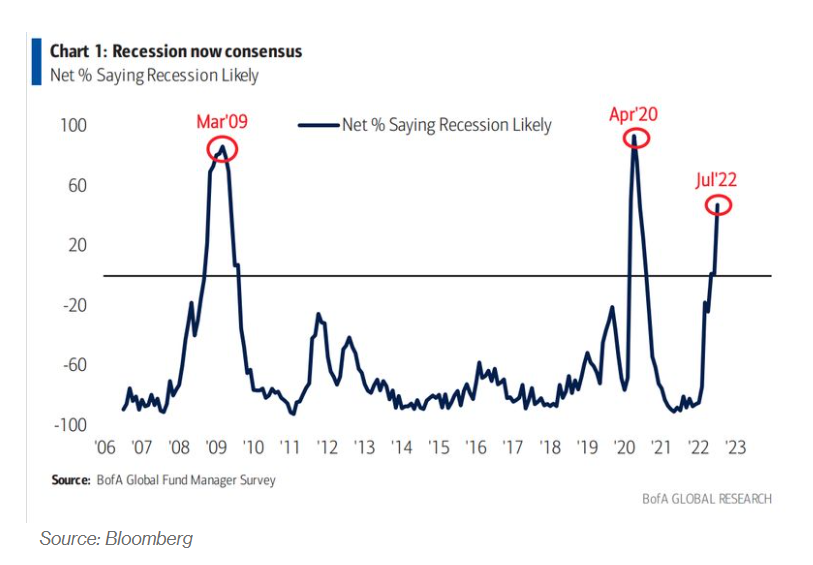

The second chart from the Bank of America survey shows the consensus among investors believing a recession is imminent. While the reading is not quite as high as it was during the pandemic or at the end of the financial crisis, it still registers a very high reading.

These two charts are important to take note of because they have proven to be excellent indicators of market bottoms in the past. While Stocks drifted lower from October 2008 to March 2009, it marked the beginning one of the longest running bull markets in U.S. history. Likewise, after stocks bottomed in April 2020, their rebound amazed analysts.

if you have any questions, please contact me.

The Markets and Economy

- The median price of an existing home in the U.S. rose to $416,000 as sales declined for a fifth straight month. Existing home sales fell 5.4% from the previous month. However, homes for sale are only staying on the market a average of 14 days, the fewest number of days going back to 2011.

- The price of copper peaked at $4.92 per pound in March. Since then, it has fallen 34% to $3.23 per pound. Copper has so many uses across the economy that many analyst consider it an indicator of future economic growth or recession.

- Frustrated homeowners in China are threatening to withhold loan payments to banks on long-delayed unfinished housing projects. Citizens posted their frustrations on social media platforms that were quickly removed by Chinese censors. Overbuilding in the world’s second-largest economy has been plagued by Covid shutdowns as China’s zero-tolerance policies compound the economic challenges.

- The U.K.’s inflation is every bit as bad as in the U.S. The annual rate of inflation hit 9.4% year-over. That was the sharpest increase since 1982.

- Foreign purchases of U.S. homes slowed for the fifth straight year as the pandemic continued to limit international travel and the dollar strengthened.

- The European Central Bank raised interest rates a half-point to deal with inflation pressures in the EU. The increase was more than expected as the ECB attempts to get ahead of inflationary concerns.

- I usually stay away from discussing politics but I found this interesting. A recent Gallup poll found 77% of 900 registered voters surveyed in June believe that “most members in Congress” do not deserve to be reelected to another term.

- U.S. and global business activity fell sharply in July. A survey of purchasing managers shows a downturn in factory output for major world economies. The U.S. purchasing managers index registered a reading of 47.5. A reading below 50 indicates an economy in contraction.

Offices in Chicago, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This newsletter was prepared by David M. Kover®. To unsubscribe from the Weekly Market Update please write us at 555 Eastport Centre Dr., Suite B, Valparaiso, IN 46383 or click this link: Unsubscribe .

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, LLC, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors, LLC.