Rather than send out my market commentary at the beginning of the week, I thought I’d wait a couple of days and close out 2019. The markets were able to hold onto gains accumulated during the year. While corporate profits dipped slightly, optimism reigned as investors took the news of a “phase one” deal with China will help ease the trade conflict. President Trump is expected to sign the agreement on January 15th. After that, the president is expected to travel to Beijing to negotiate a broader trade deal.

As U.S. equity markets logged their best performance since 2013, investors are wondering what lies in store for the new year. We’ll continue to keep our equity exposure to domestic markets as Europe continues to struggle with a recession and emerging markets stay flat.

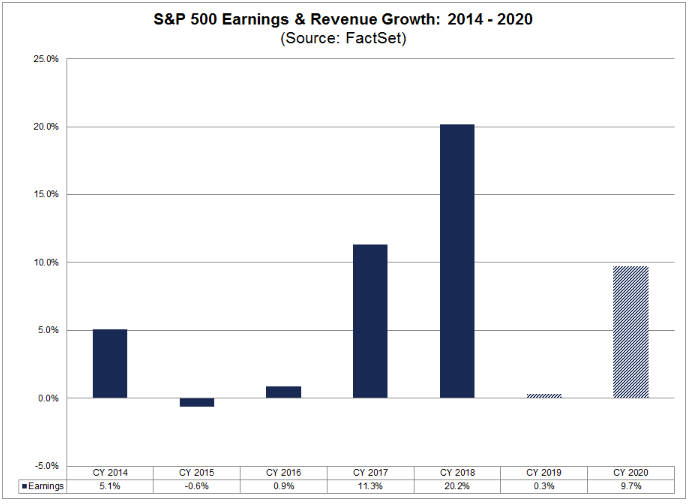

The chart below comes courtesy of FactSet. It shows analysts predictions for growth in the U.S. for the next couple of years. Growth peaked in 2018 coming in at an annualized rate of 2.9%. Getting close to the Fed’s 3% growth target resulted in the central bank raising rates three times that year. With growth moderating to an estimated 2.3% for 2019, it gave the Fed room to reverse course and cut rates three times. For 2020, estimates are for the economy to slow further to 1.8%. Only in 2021 do analysts expect growth to begin to climb upward.

The silver lining in these projections is, if actual results come in higher, markets could hold onto or even continue to gain momentum. Only time will tell.

The biggest news, in my opinion, was the signing of the Secure Act by President Trump. This piece of legislation signed a week before Christmas will affect investors in many ways. In next week’s market commentary, I will begin to review the points everyone needs to be aware of