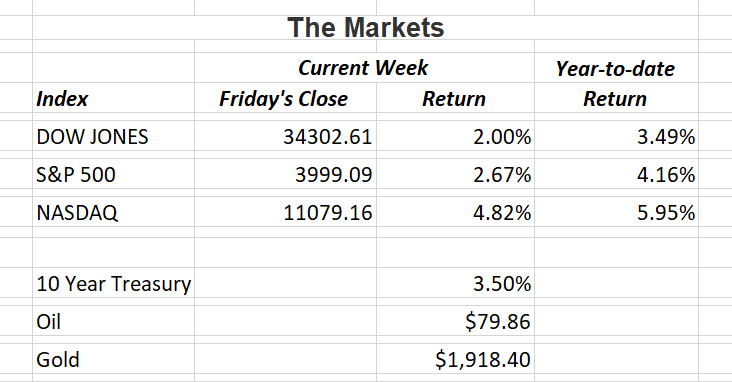

U.S. equity markets posted solid gains for the second consecutive week in the new year. Last week’s good news consisted of inflation continuing to ease and better-than-expected earnings from big banks as fourth quarter earnings season gets started. Here are the details.

The consumer price index rose 6.5% last month, down from the previous month’s reading of 7.1% and well below the peak of 9.1% last June. The data added to signs that inflation is turning the corner after last year’s surge. It will also help keep the Fed more moderate with their future interest rate increases. The Fed’s next meeting concludes on February 1. That’s when we’ll learn the central bank’s decision for another rate increase.

Fourth quarter earnings season started last week with major banks reporting first. Reports from JPMorgan Chase and Bank of America showed many lenders have benefitted from the Fed’s interest rate increases which allows them to earn more from loans. However, fourth quarter earnings results are just getting started. Currently, the S&P 500 is expected to post a year-over-year earnings decline of 3.9%. If that happens, it will be the first year-over-year decline since the third quarter of 2020.

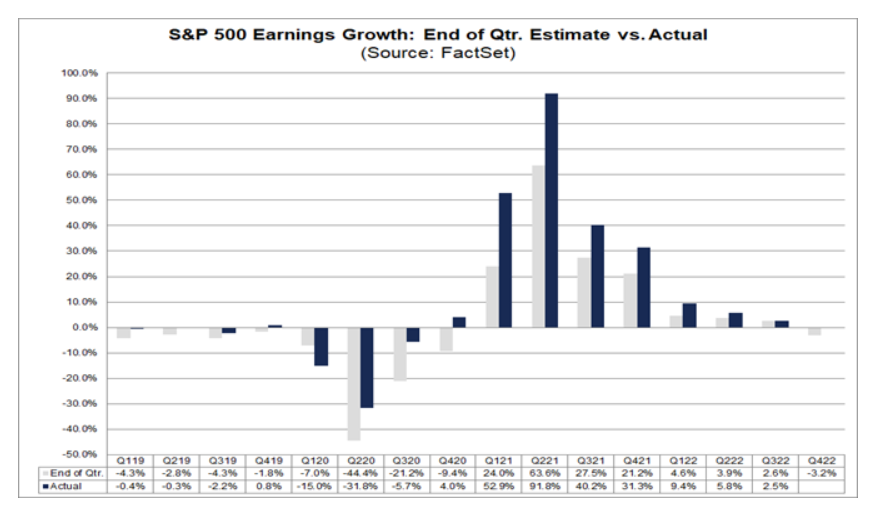

The important thing investors need to keep in mind is best illustrated in the chart below from FactSet. The shaded bars are estimated earnings growth rate for the S&P 500 and the solid blue bars are actual results. Simply put, over the last 40 quarters of earnings announcements, S&P 500 companies have beaten the estimated earnings growth rate 38 times. That’s 95% of the time. If that trend continues to hold true, we can expect earnings to come in higher.

I have consistently written about the strength of the U. S. economy over the last year. I continue to believe in it and the prospects for the stock market.

If you have any questions, please contact me.

The Markets and Economy

- Not to be outdone by Southwest Airlines, an outage of a federal pilot-alert system cascaded into a nationwide logjam at S. airports last Wednesday. The breakdown of the FAA’s computer system resulted in thousands of flights delayed or cancelled. The two situations over the last few weeks highlights the fragility of the nation’s air transportation’s aging technology infrastructure.

- After starting a consumer business arm in 2016, Goldman Sachs Group reported it has lost about $3 billion over the last couple of years. The consumer venture was never profitable and has caused the bank to reorganize reporting for various units.

- During a panel discussion with other central bankers in Sweden last week, Fed Chairman Jerome Powell said they remain committed to lowering inflation by restraining economic growth through interest rate increases. The chairman went on to say that the Fed should “stick to our knitting, and not wander off” into issues that aren’t directly linked to its mandates.” He went on to say, “We are not, and will not be, a climate policy maker.” His remarks were in response to suggestions that the central bank take a more proactive role in climate change.

- Tens of thousands of travelers began to fly in and out of mainland China last week as Beijing removed almost all border restrictions. A strict zero-tolerance policy forced a national shutdown and crippled the world’s second-largest economy. Questions still remain as foreign investors have pulled more than $100 billion out of China’s bond market since February of last year. Equity investments have also dropped significantly.

- According to the monthly Logistics Managers’ Index, transportation utilization fell into what is considered “contraction territory” in December. That was the first time the reading has dropped this low since April 2020 when the pandemic was just beginning.

- The World Bank has lowered its growth forecast for the global economy in 2023. The bank said persistently high inflation creates the risk of a world-wide recession later this year.

- From the outset of the Covid outbreak through last July, the three states that saw the largest outflow of residents were California, New York and Illinois for a net loss of 1.8 million people. On the other hand, Florida, Texas and North Carolina saw the largest gains totaling 1.3 million for new residents.

Offices in Chicago, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This newsletter was prepared by David M. Kover®. To unsubscribe from the Weekly Market Update please write us at 555 Eastport Centre Dr., Suite B, Valparaiso, IN 46383 or click this link: Unsubscribe .

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors LLC, member FINRA/SIPC. Triad is separately owned and other entities and/or marketing names, products or services referenced here are independent of Triad Advisors LLC.

Investment advice offered through One Digital Investment Advisors, LLC, an SEC-registered investment adviser. One Digital Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors LLC.