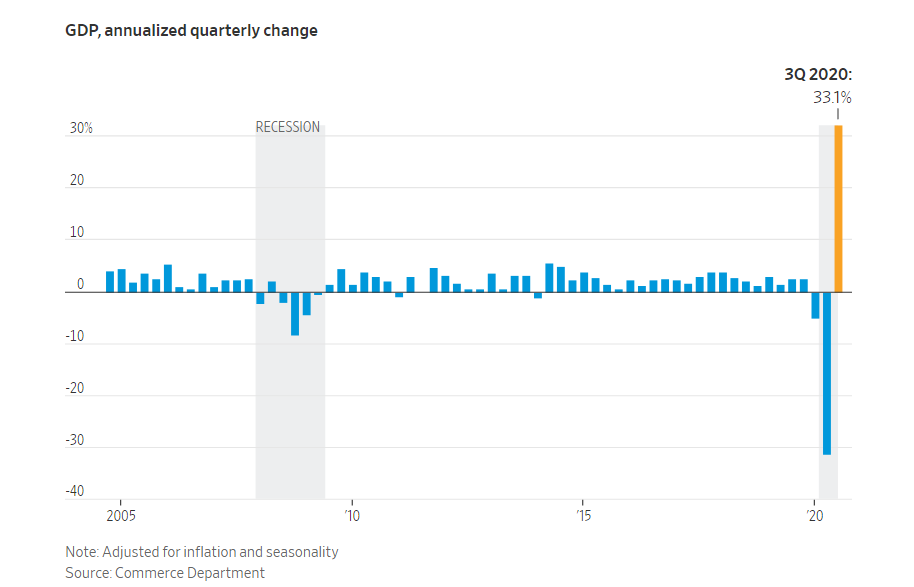

The big news last week was the growth in the U.S. economy. Gross Domestic Product, the value of all goods and services produced across the economy jumped a record 33.1% in the third quarter. Over all, GDP has recouped about two-thirds of the contraction due to the pandemic.

We still have a long way to go considering the recent spike in coronavirus cases across the world. Still, the chart below from the U.S. Department of Commerce is striking in seeing just how far the economy contracted and how it has recovered considerably.

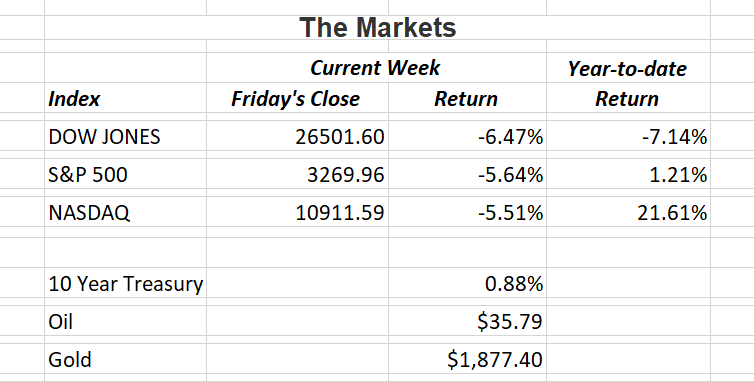

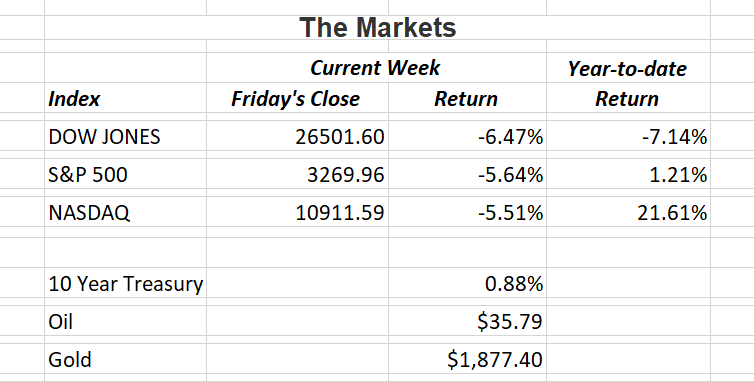

According to FactSet, 64% of S&P 500 companies have reported third-quarter earnings results. The percentage of companies beating earnings-per-share estimates are at or near record levels. Despite the increase in earnings, the index is still reporting its third-largest year-over decline in earnings since the third quarter of 2009. However, the S&P 500 is projected to report year-over-year earnings growth in the first quarter of 2021.

By the time you read this market commentary, it will be the one-day countdown to one of the most divisive presidential elections we have seen in modern times. While it may be weeks before we know the final outcome, please remember, we are one nation and one people.

The Markets and Economy

- The coronavirus is staging a comeback from the U.S. to Europe. Many countries in Europe are experiencing a second phase of lockdowns to deal with the sharp increase in cases. Some hospitals are reporting bed shortages, especially in ICU’s. Economists worry about the sustained negative effect on small businesses.

- As the pandemic drags on, U.S. factory production of consumer products has largely recovered. Buyers are scooping up goods at an increasing rate as consumers spend more time at home and nervous about travel. This puts added pressure on manufacturers to keep up with the increased demand. The U.S. Commerce Department reported durable goods orders rose 1.9% in September from August far outpacing the 0.4% gain analysts had projected.

- Home prices continue to climb. An index that measures average home prices in major metropolitan areas across the nation rose 5.7% in the year that ended August 31. That’s up from the previous months increase of 4.8%.

- Jeff Bezos, founder of Amazon is the world’s richest man. His net worth is estimated to be $189 billion. Mr. Bezos was named Time magazine’s “Person of the Year” in 1999.

- According to the Bureau of Labor Statistics, it would take almost $2,000 today to equal the buying power of $1,000 in 1990.

- Concerns are mounting over the billions in shortfalls for state coffers. Income and sales taxes are the main source of revenue for most states. That has evaporated significantly with the pandemic.

- Amazon.com, Inc. plans to hire 100,000 seasonal workers in the U.S. and Canada heading into the Thanksgiving and Christmas holidays. This is on top of previous hiring announcements Amazon has made.

- Household spending increased for the fifth straight month as the U.S. economy continues to claw it’s way back from the effects of the pandemic.

- The U.S. auto industry is bouncing back stronger than analysts anticipated. The pace of new-vehicle sales over the past few months has rebounded to the strong levels seen before the pandemic.

Offices in Chicago, Kansas City, St. Louis, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Imvestment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors.