First quarter earnings season kicked off last week. It’s still early with only 9% of S&P 500 companies reporting results. Earnings will be a mixed bag of numbers. January and February escaped much of the impact of the coronavirus pandemic with March starting to feel the effects of business closures and mass layoffs. We’ll continue to follow and report on first quarter earnings but take them with a grain of sand. The real focus will be on second quarter results and how well the economy can bounce back.

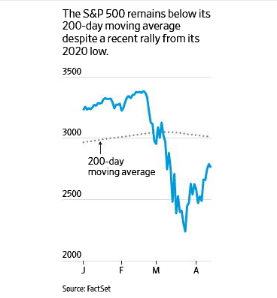

After bottoming on March 23, the S&P 500 has rallied about 23%. Some investors believe it’s the “all clear” sign and are ready to see continued improvement in the market. The chart below comes from the Wall Street Journal last week and shows just how sharply the draw down and bounce back have occurred. While we firmly believe the market will be fine in the long run, we do have some concerns about how quickly this rebound has happened.

A few weeks ago I mentioned that it would actually be healthy in the long run for the market to pull back near the March 23 lows. It doesn’t have to actually hit that mark, but it needs to pull back and hold above it. Any ensuing rebound from there stands a greater chance of success.

One indicator technical analysts follow is the index breaking above its 200-day moving average. Right now, that is about 3015. Currently the S&P 500 is still about 150 points away from that mark.

There is plenty to be thankful for. In many areas of the U.S., it appears we may be seeing the tide turn against the coronavirus. It will surely be a long road to see deaths and new cases drop significantly. We’ll continue to update you on first quarter earnings results and revisions for the second quarter. Be safe.

Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal, FactSet. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors, LLC