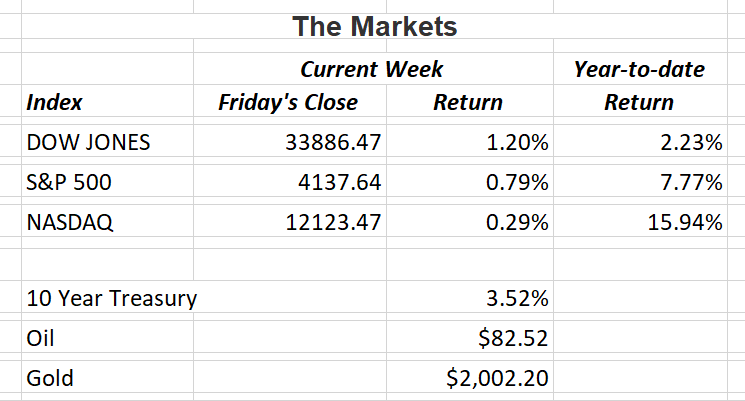

U.S. stock indices managed to post another weekly gain as big banks were first up to report earnings. JPMorgan Chase & Co. posted a 52% jump in profits. Wells Fargo and Citigroup also beat analysts estimates. UnitedHealth beat forecasts and increased their 2023 outlook. First quarter earnings season is definitely off to a good start.

Inflation figures continued to ease in March but price pressures still remain. Rent by far was the biggest contributor to inflation last month according to the Bureau of Labor Statistics. Many homebuyers have been pushed out of the housing market due to a combination of higher mortgage rates and a persistent low supply of inventory. This has created a surge in demand for apartments and is the main reason prices have risen so much. Fortunately, a significant number of apartment units are expected to become available later this summer which should help pricing pressures.

The Fed meets again in May. Whether the raise interest rates by another 0.25% or hit the pause button is anyone’s guess. It will all come down to the central bank’s concern over inflation vs. recession. Treasury Secretary Janet Yellen said she believes a soft landing for the U.S. economy is still possible. However, a few Fed Governors believe fighting inflation is still job #1, and it is not over yet. They said a recession is a strong possibility by the end of the year.

So what does this mean for investors? We don’t know how the Fed’s interest rate policies may affect the stock market. What we do know is that corporate earnings drive stock prices. That is why so much attention is being paid to this new earnings season.

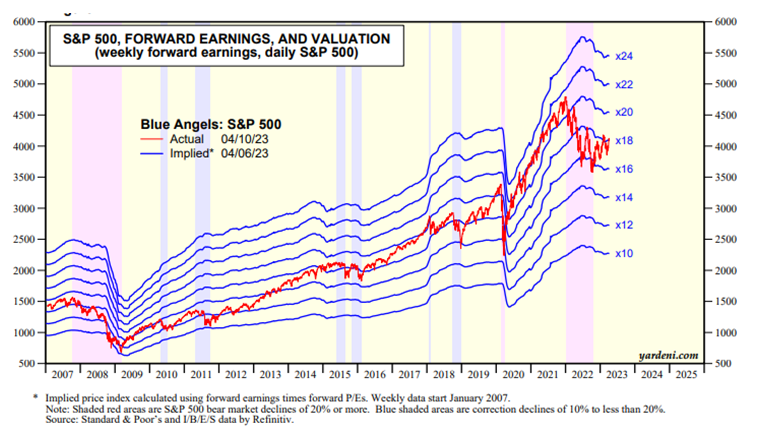

To help determine if the stock market is cheap or expensive, analysts focus on several metrics. One tool is called the forward price-to-earnings (P/E) ratio. This shows the relationship of stock prices compared to the sum of corporate earnings. The higher the P/E ratio, the more overvalued the stock market is. Conversely, the more it drops the more undervalued it becomes. Since the end of last year’s bear market on October 12, the S&P 500 has been trading mostly between a forward P/E ratio of 16 and 18. Looking at the chart below from Standard & Poor’s, we see that with the market upswing in the first quarter, the forward PE ratio is now about 18. That means we have a fairly valued market if earnings continued to show positive growth.

Over the next few weeks I’ll continue to report on earnings and how the market reacts. stay tuned.

If you have any questions, please contact me.

The Markets and Economy

- American consumers pulled back on their spending last month. Purchases at stores, restaurants and online declined a seasonally adjusted 1% in March.

- China’s exports rose sharply in March. Analysts said a combination of increased trade with Asia and Europe helped push exports higher. Also, trade with Russia more than doubled from a year ago.

- Good news for U.S. grocery shoppers, prices are finally dropping. Of six major grocery food group indexes, three fell from February to March. The meats, poultry, fish and eggs index fell 1.4%. Fruits and vegetables dropped 1.3% while dairy products dipped 0.1%.

- After hitting a record high of 12.03 million in March 2022, job openings in the monthly Job Opening and Labor Turnover Survey (JOLTS) fell below 10 million in February for the first time since May This shows the Fed’s interest rate increases are having the desired effect of slowing down inflation.

- Prices at the producer level continue to moderate. U.S. supplier prices fell in March by the most in any month since 2020. From a year earlier, supplier prices rose by 2.7% in March, a significant slowdown from highs reached last year but still above pre-pandemic levels.

- The International Monetary Fund (IMF) forecasts the U.S. economy to expand 1.6% in 2023. That’s down from 2022’s growth of 2.1%. The IMF cited tighter bank lending due to the failure of Silicon Valley Bank and Signature Bank. It also cited persistently high interest rates as a reason for slower economic growth.

- According to the Dallas Fed’s recent survey on banking conditions, loan volumes and demand fell to their lowest level since the pandemic. The decline was felt in all sectors. However, consumer demand fell the most.

- Increasing labor tensions at west coast shipping ports are sparking fears that work stoppages could disrupt the flow of goods through one of the country’s largest gateways. Targeted work slowdowns have been seen as the International Longshore and Warehouse Union continue to negotiate for a new contract. The crucial back-to-school and holiday selling seasons are just right around the corner.

Offices in Chicago, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This newsletter was prepared by David M. Kover®. To unsubscribe from the Weekly Market Update please write us at 555 Eastport Centre Dr., Suite B, Valparaiso, IN 46383 or click this link: Unsubscribe .

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors LLC, member FINRA/SIPC. Triad is separately owned and other entities and/or marketing names, products or services referenced here are independent of Triad Advisors LLC.

Investment advice offered through One Digital Investment Advisors, LLC, an SEC-registered investment adviser. One Digital Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors LLC.