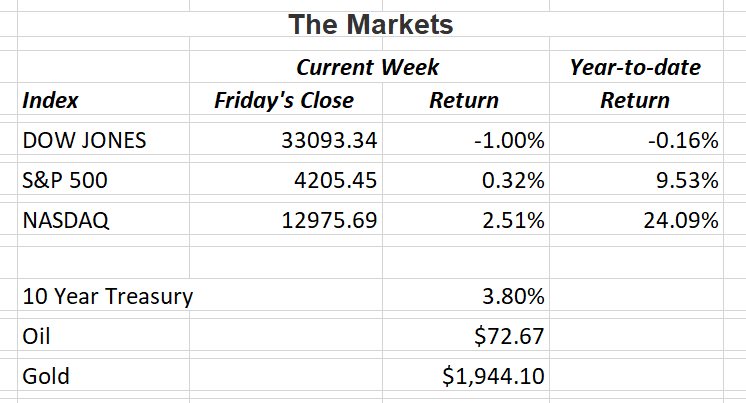

Markets rallied on Friday as hopes for a resolution to the debt ceiling seemed to be taking shape. Details of a deal weren’t final Friday afternoon, but many investors seemed confident an agreement would pass Congress before the June 5 deadline cited by Treasury Secretary Janet Yellen. President Biden said a deal is “very close.” On the week, the Dow Jones Industrial Average closed down about 1% while the S&P 500 was almost flat. The tech-heavy Nasdaq, however, posted a gain of 2.5% on a continued rebound in tech stocks. The Nasdaq is up over 24% year-to-date.

Minutes from the Fed’s May meeting shows agreement on the 0.25% rate increase earlier this month but were divided on whether a June increase should happen. Several officials noted that if the economy evolved along the same lines of the their current outlook, then growth should slow and inflation continue to recede. Unfortunately, with last week’s figures, it appears inflation and the economy haven’t gotten the message.

Consumers sharply increased their spending in April and inflation accelerated. Consumer spending is the primary driver of economic growth and rose a strong 0.8% last month according to the Commerce Department. That was after posting slight gains of 0.1% in both February and March.

The Fed’s preferred gauge of consumer prices is the personal-consumption expenditures price index. It rose last month 4.4% from a year earlier and up from March’s figure of an increase of 4.2%. The chart below from the Commerce Department and the St. Louis Fed shows prices declining for the second half of 2022 and now starting to rebound.

The question now becomes, will the Fed give inflation more time to show the effects of the previous 10 interest rate increases, or will they feel it necessary for another 0.25% increase at their June meeting. If the central bank does raise rates again, it will bring the federal-funds rate to 5.25%-5.50%: A level not seen in decades.

If you have any questions, please contact me.

The Markets and Economy

- Everyone thought deposits were going to flow out of smaller banks in favor of larger institutions after the Silicon Valley Bank However, the smallest banks only saw modest outflows and regional banks actually experienced inflows according to the New York Fed.

- Retail sales were up 1.6% year-over in April. But when you factor in inflation, sales actually fell2%. Shopper’s budgets remain under pressure from inflation causing retailers to reconsider additional price increases.

- Retailers are also dealing with a rise in shrinkage; the loss of inventory due to theft or fraud. The most recent figures available are from 2021 and show a increase of 1.4% to $94.5 million. They expect 2022 to be even worse.

- The availability of new cars and trucks on dealership lots is bouncing back. At the end of April, dealerships saw a 50% improvement in inventory compared with the same period in 2022 but still have a long way to go. Inventories are still down about half of what they were two years ago.

- According to a recent Federal Reserve survey, Americans reported a sharp decline in their financial well-being last year as high inflation eroded earnings and savings.

- China has long dominated lithium refining but has recently been spending billions to secure a greater share of the world’s supply. The element is critical for lithium-ion batteries that powers electric vehicles, appliances, and smartphones.

Offices in Chicago, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This newsletter was prepared by David M. Kover®. To unsubscribe from the Weekly Market Update please write us at 555 Eastport Centre Dr., Suite B, Valparaiso, IN 46383 or click this link: Unsubscribe .

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors LLC, member FINRA/SIPC. Triad is separately owned and other entities and/or marketing names, products or services referenced here are independent of Triad Advisors LLC.

Investment advice offered through One Digital Investment Advisors, LLC, an SEC-registered investment adviser. One Digital Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors LLC.