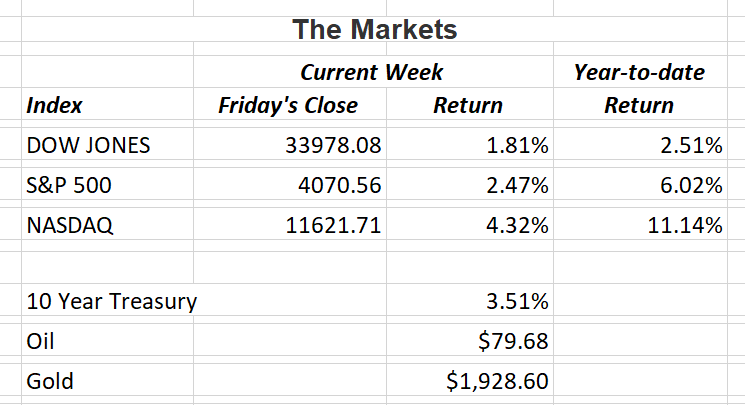

U.S. stocks continued to rally last week as major indices are set to post a strong gain for the first month of the new year. The mood for most investors has made a shift from worrying about inflation to believing we may have turned the corner. This means the Fed has reason to slow their pace for interest rate increases through 2023, and hopefully will engineer a “soft landing.” Here is what we saw last week.

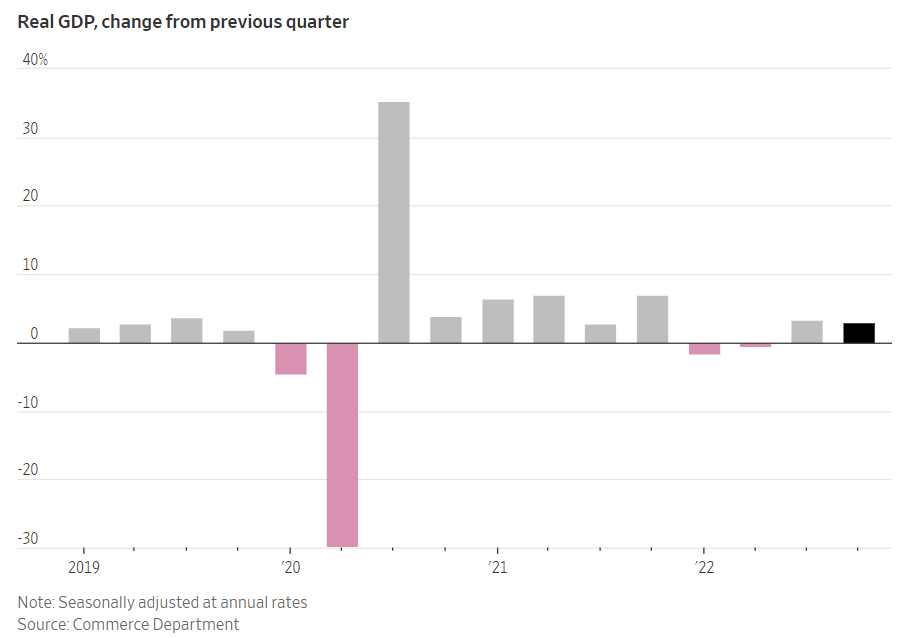

In the chart below from the Commerce Department, we see that Gross Domestic Product (GDP) rose a solid 2.9% annual rate in the fourth quarter. That’s down from the third quarter’s 3.2% annual rate. This shows a gradual slowing in economic activity, and is exactly what the Fed needs to see happen to slow further rate increases.

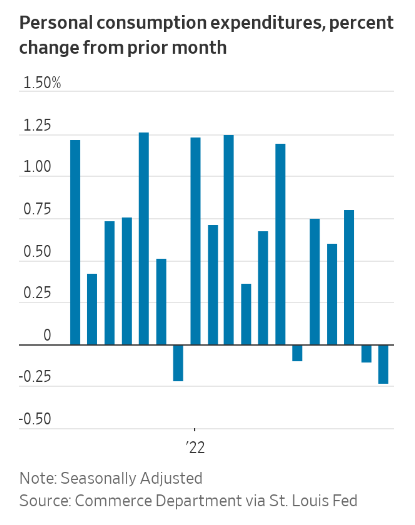

Consumers spent less during the holiday season as spending fell a seasonally adjusted 0.2% in December. On a month-to-month basis, the Personal Consumption Expenditure (PCE) price index rose 0.1% in December matching November’s increase. This is further good news that prices and inflation are moderating. The chart below is from the Commerce Department via the St. Louis Fed.

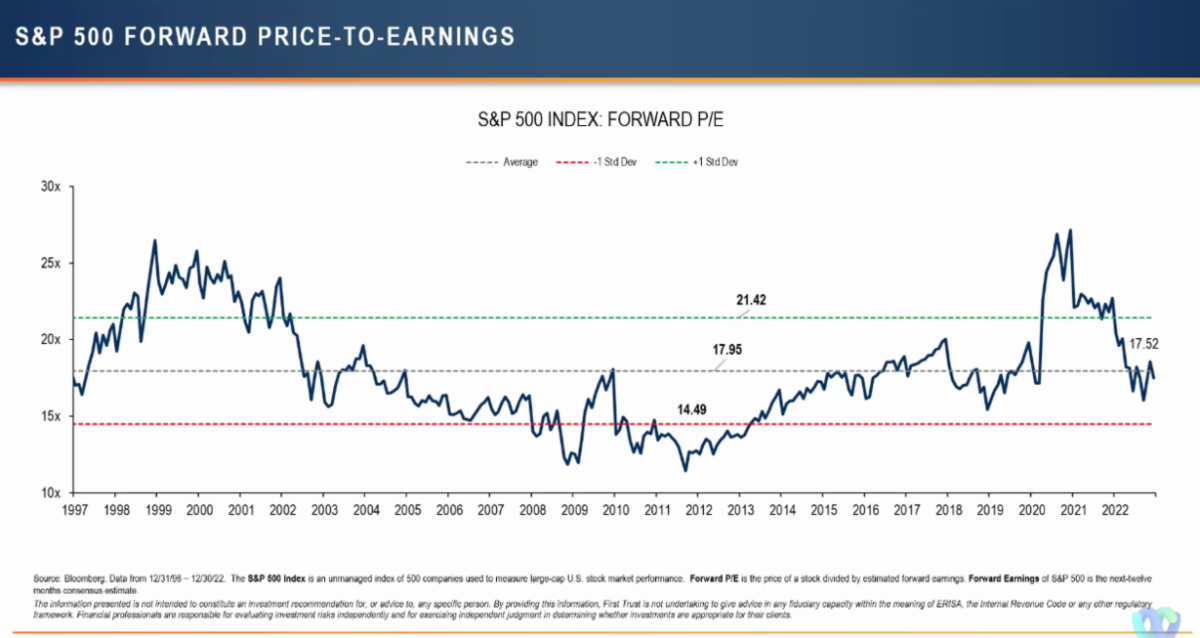

Finally, we see what has happened to the price-to-earnings (PE) ratio as corporate profits are still strong but the stock market fell for much of 2022. Back in 2021, the PE ratio reached a high of 26 (see chart below from First Trust). This means stocks became very expensive as investors pushed prices higher due to increasing corporate earnings. When earnings began moderating, stock prices fell, putting this key indicator back to a more historical norm.

2022 was a tough year for investors. The good news is, hopefully we have turned the corner.

If you have any questions, please contact me.

The Markets and Economy

- According to a Wall Street Journal review of labor data, small companies have accounted for all of the net job growth in the S. since the onset of the Covid-19 pandemic. This accounts for nearly four of five available job openings. One economist noted; “Small businesses are holding up the labor market.” The National Federation of Independent Business Optimism Index recently dropped 10 points below the 40-year historical average showing small-business owners are not optimistic about 2023.

- Big banks are joining forces to launch a digital wallet that consumers can use when shopping. Well Fargo, Bank of America and JPMorgan Chase along with four other banks are working on a new product to compete with PayPal and Apple Pay.

- The Department of Justice filed a lawsuit ordering Alphabet to split Google’s ad business. The DOJ alleges Google abuses its role as one of the largest brokers, suppliers and online auctioneers of ads placed on website and mobile apps. A protracted court battle will definitely ensue as Alphabet said it will vigorously fight the lawsuit.

- Restaurants were one of the hardest hit businesses during the pandemic. Fortunately, that trend has reversed course. Sales at bars and restaurants grew over 12% in 2022.

- Staffing shortages are plaguing the nations largest drugstore chains. CVS Health Corp., Walmart Inc. and Walgreens Boots Alliance Inc. are reducing pharmacy hours of operation. The chains have been working to stop an exodus of pharmacists by offering bonuses, higher wages and guaranteed lunch breaks.

- Workers at the bottom of the income scale saw the largest pay increases last year. Inflation and a tight labor market across the S. resulted in employers offering higher wages and signing bonuses in some cases.

- Walmart said it is raising wages for its U.S. hourly workers as the country’s largest private employer continues to struggle with attracting staff in a tight labor market. Beginning next month, workers in stores and warehouses will earn a starting wage of at least $14 an hour, up from $12. Rivals, Amazon and Target have a $15 minimum wage.

Offices in Chicago, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This newsletter was prepared by David M. Kover®. To unsubscribe from the Weekly Market Update please write us at 555 Eastport Centre Dr., Suite B, Valparaiso, IN 46383 or click this link: Unsubscribe .

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors LLC, member FINRA/SIPC. Triad is separately owned and other entities and/or marketing names, products or services referenced here are independent of Triad Advisors LLC.

Investment advice offered through One Digital Investment Advisors, LLC, an SEC-registered investment adviser. One Digital Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors LLC.