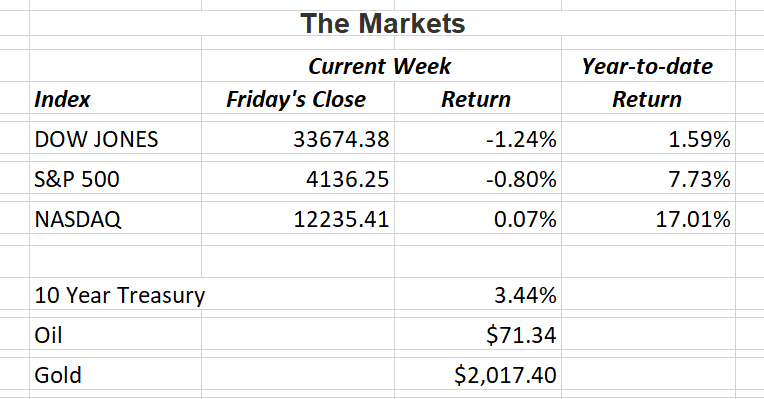

The Dow Jones Industrial Average and S&P 500 posted slight losses for the week and the Nasdaq was flat. It was another roller coaster week as markets continued to deal with both an aggressive central bank and more uncertainty in the regional bank sector. First, let’s examine the jobs report that came out on Friday.

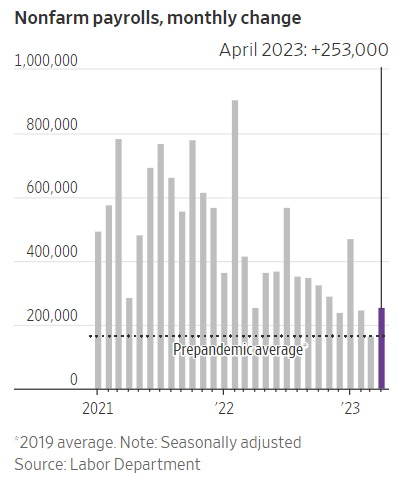

After declining mostly through 2022 nonfarm payroll changes rebounded in April to post a gain of 253,000 new jobs. The official unemployment rate declined slightly to 3.4% matching the lowest reading since 1969. The stock market recovered a significant amount of its losses from earlier in the week when concerns over regional banks continued to fray investors nerves. The chart below from the Labor Department illustrates the situation.

California bank, PacWest Bancorp lost about 50% of its value on Thursday over concerns that large depositors were withdrawing funds. Other regional banks posted share declines of 20% – 30%. PacWest faces similar problems other regional banks are facing; a large concentration of big depositors. Regional banks work with middle market businesses in the U.S. Because of that, businesses tend to have large deposits with their banker. The large deposits secure loans and help companies access cheaper credit. This is the way it is supposed to work.

The problem lies in dealing with the sharpest federal funds rate increase in memory. We have gone from 0% at the beginning of 2022 to 5% last week. Obviously the Fed is fighting inflation. Higher interest rates will slow down consumer spending and business expansion. With business slowing down, companies need to draw down the money they keep in their bank for operations. Here’s where the problem occurs.

Banks have to keep reserves. But they don’t keep them on hand in the form of cash. They buy government bonds. They’re supposed to do that. Here is where the first thing I learned in this business 35 years ago comes into play. Bond prices and yields have an “inverse” relationship. That means when interest rates rise, bond prices fall. Here’s an example: You buy a bond for $1,000 paying 3% interest. Next week, the Fed raises interest rates and is now offering bonds paying 3.5%. Since no one wants to buy your bond paying 3%, the price of it drops. Now you can just hold onto the bond until it matures and you’ll get your full $1,000 back. But if you’re a bank and customers are withdrawing funds partially fueled by fear of a bank not having enough to meet demand, you have to sell the bonds at a loss to satisfy customer withdrawals.

Banks do have a position called a Risk Officer. Their job is to help hedge the banks portfolio against rising interest rates. But when we have the sharpest interest rate increase in history happening, it’s impossible to hedge completely.

I know this is a long-winded commentary this week, but I’ve had several clients call asking me to explain what it happening in the banking sector. Trust me…this is the short version of my answer. In closing I’d like to stress that this is in no way similar to the financial crisis we experienced in 07-08 when lending standards seemed to disappear. In fact, PacWest stock jumped 82% on Friday on news that potential partners and investors are ready to assist the bank. Other regional banks saw significant gains on Friday as well. And I forgot to mention, first quarter earnings continue to come in strong.

If you have any questions, please contact me.

The Markets and Economy

- In recent months, China has restricted or outright cut off overseas access to various databases involving corporate registration information, patents, procurement documents academic journals and official statistical yearbooks. President Xi Jinping has emphasized “national security” as China’s Party-state ramps up efforts to obscure and block critical information. The unfortunate trend may have already started. Foreign investment into China dropped by almost half in 2022 from a year earlier.

- The demand for workers is cooling off. S. job openings dropped to their lowest level in nearly two years in March as layoffs rose sharply.

- Through April 26, 74% of S&P 500 companies reporting first quarter results have exceeded earnings forecasts and 65% beat sales estimates.

- With U.S. mortgage rates falling from their highs, home builders are experiencing a stronger-than-expected sales rebound. Persistently low inventory has put builders in a good spot. Newly built homes made up about one-third of single-family homes for sale in March.

- Treasury Secretary Janet Yellen warned the U.S. could default on its debt as soon as June 1 if the nation’s debt limit isn’t raised. The House has sent its proposed legislation to the Senate where it is expected to fail. Posturing by both parties is leading to a possible make-or-break last minute deal.

- Some of the nation’s largest pension funds are looking at paring back their stock allocation. With bond yields high and the possibility of a recession looming, pensions fear possible stock losses.

Offices in Chicago, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This newsletter was prepared by David M. Kover®. To unsubscribe from the Weekly Market Update please write us at 555 Eastport Centre Dr., Suite B, Valparaiso, IN 46383 or click this link: Unsubscribe .

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors LLC, member FINRA/SIPC. Triad is separately owned and other entities and/or marketing names, products or services referenced here are independent of Triad Advisors LLC.

Investment advice offered through One Digital Investment Advisors, LLC, an SEC-registered investment adviser. One Digital Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors LLC.