- Is business travel making a comeback? Travel and expense-management company Campbell Travel said that 67% of its business in March was related to corporate travel. That’s up from 51% reported in January.

- U.S. business ramped up its investment in technology and other capital items in 2021. Private nonresidential business investment grew 7.4% last year over the previous year. That was the fastest pace since 2012 and a strong rebound from the -5.3% decline in 2020.

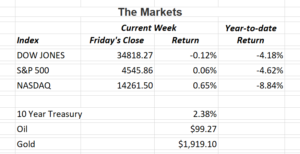

- The U.S. bond market suffered its worst decline in nearly 40 years. The Bloomberg U.S. Aggregate bond index comprised mostly of U.S. Treasury’s, highly rated corporate bonds and mortgage-back securities-returned a minus 6% in the first quarter.

- According to the Department of Labor, the number of job openings was 6.9 million in February 2020 and 11.3 million in February 2022. During the same period, there were 5.7 million Americans unemployed then vs. 6.3 million now.

- The Russian government has a $2 billion bond maturing on Monday, April 4th. This is Moscow’s first maturing bond since the invasion of Ukraine. Questions are circulating about Russia’s ability to make payment.

- President Biden has announced plans to release up to 180 million barrels of government oil reserves in an attempt to reduce the price of oil and gas to U.S. consumers. This amounts to 1 million barrels a day. The U.S. currently uses about 20 million barrels a day of crude.

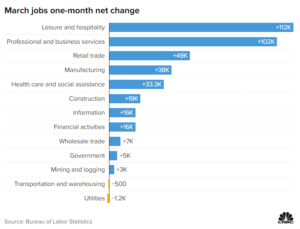

- Employers added 431,000 jobs in March showing continued strength in the U.S. labor market. The unemployment rate fell to 3.6% from March’s 3.8% reading.

- Chinese developers are facing another struggle after dealing with a sector-wide downturn; resigning auditors. PricewaterhouseCoopers quit as auditor for three major developers in China over concerns about off-balance sheet debt. The accounting firm said pandemic-related restrictions are making it difficult to collect accurate information.

- From 12/31/2019 to 02/28/2022, the number of existing homes for sale in the U.S. fell from 1.39 million to 870,000. That’s a drop of 520,000 according to the National Association of Realtors. The result is continued acceleration in home-price growth. Year-over home prices rose 19.2% as of the end of January.

- Major auto manufacturers reported a pullback in U.S. sales for the first quarter of 2022. Fewer cars on dealers’ lots due to a shortage of computer chips are crimping sales.

|

|

Offices in Chicago, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors.

|