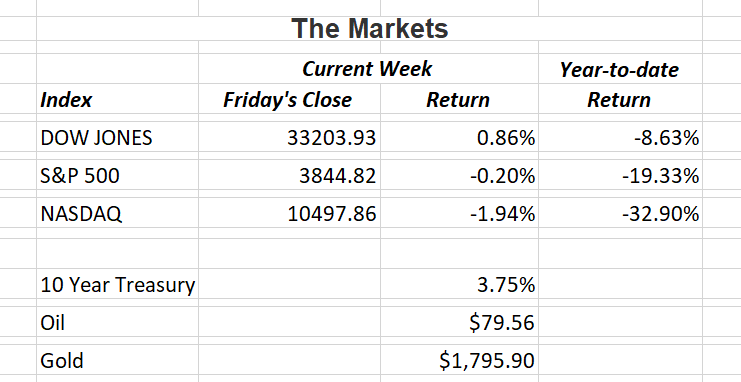

U.S. equity markets were mostly flat last week as fresh evidence that the Fed’s aggressive interest rate increases are beginning to take effect. The challenge remains as it has been for the last couple of months; Is the economy slowing enough to satisfy the central bank? Until that happens, any news of strong growth will result in further market declines over concerns of continued Fed tightening.

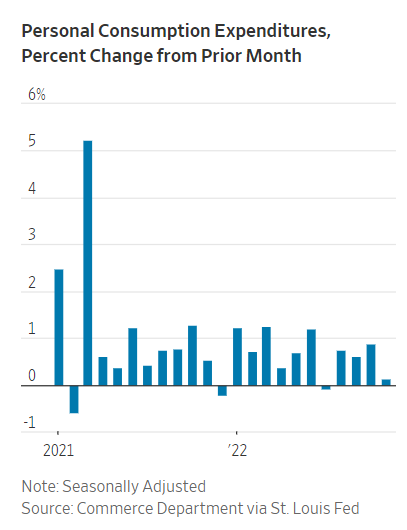

The chart below from the U.S. Department of Commerce shows how much consumer spending has drifted lower.

This week’s market commentary will be brief as I spend the holidays with family out of town.

Wishing all of our readers health, wealth and happiness for 2023.

If you have any questions, please contact me.

The Markets and Economy

- Home sales dropped 7.7% in November for the tenth consecutive monthly decline. The pressure on home sales is due to a continued lack of inventory coupled with higher mortgage rates.

- The Bank of Japan, the last central bank holdout on ultralow interest rates, sent ripples through global markets last week when it raised rates from 0.25% to 0.50%. Other nations have been feeling the effects of inflation and raising interest rates accordingly. However, Japan seems to have been spared the worst of it.

- Wells Fargo & Co. reached a $3.7 billion deal with regulators to resolve allegations that it harmed more than 16 million customers with deposit accounts, auto loans and mortgages. The record fine was in response to the bank overcharging and unlawfully charging fees on various types of loans.

- Even though home sales are dropping due to a sharp rise in mortgage rates and a severe lack of inventory, economists don’t expect a repeat of the housing crisis of 2008. Between 2006 and 2009, home prices dropped about 28%. That triggered wide-spread defaults and a near-collapse of the financial system. But now, banks have stayed away from shady mortgage practices and many buyers are putting sizeable down payments on their new homes.

- Congress passed a $1.65 trillion spending bill last Friday. The bill funds the federal government for the entire year of 2023.

The U.S. population grew 0.4% last year continuing historically slow growth that has added pressure to a tight labor market.

Offices in Chicago, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This newsletter was prepared by David M. Kover®. To unsubscribe from the Weekly Market Update please write us at 555 Eastport Centre Dr., Suite B, Valparaiso, IN 46383 or click this link: Unsubscribe .

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, LLC, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors, LLC.