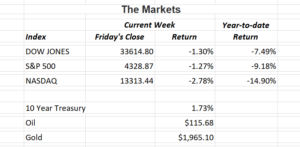

The stock market extended its losses for a fourth week as concerns over Russia’s invasion of Ukraine continued to dominate the news. Last week was not without good news. The U.S. labor market is gaining strength as workers are joining the labor-force in increasing numbers. This means employment is approaching levels before Covid-19 began. Employers added 678,000 workers to their payrolls in February, the biggest gain in seven months according to the Labor Department. The jobless rate fell to 3.8% from 4% a month earlier.

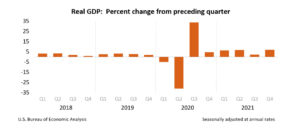

Other good news last week came from the Bureau of Economic Analysis. The Real Gross Domestic Product (GDP) increased at an annual rate of 7% in the fourth quarter of 2021. The chart below shows how strong growth was in the fourth quarter compared to the third. This continues to reinforce my belief that the U.S. economy is on solid footing. Yes there are some inflationary challenges that we face but consumers are still flush with cash and corporate profits are strong. Even the supply chain challenges are beginning to show signs of improvement.

|

The situation in Ukraine will affect U.S. consumers mostly by higher gasoline prices. However, Europe has much tighter economic ties to Russia as Europeans import much of their energy needs (oil and natural gas) from Moscow. The U.S. gets about 8% of its oil from Russia. We still consume far more oil than we extract. As this world crisis has shown, energy independence is extremely important to the U.S. economy. |

|

I expect the markets to continue with the volatility we’ve seen since the invasion, however, I am still bullish on the U.S. stock market. If you have any questions, please contact me. The Markets and Economy

Offices in Chicago, Naples & Valparaiso. The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results. \Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. Securities offered through Triad Advisors, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors. |