U.S. equity markets experienced another choppy week as investors digested more fourth quarter earnings reports and any news on the Fed’s next interest rate increase later this month. For earnings, about 11% of S&P 500 companies have reported results with slightly more than two-thirds beating analysts estimates. For news on future interest rate increases, Federal Reserve Bank of St. Louis President James Bullard spoke at a Wall Street Journal Live event last week. He said it would be appropriate to raise rates by a half percentage-point at the Fed’s next meeting on January 31. This is welcome news as the three previous rate increases by the Fed were each 0.75%.

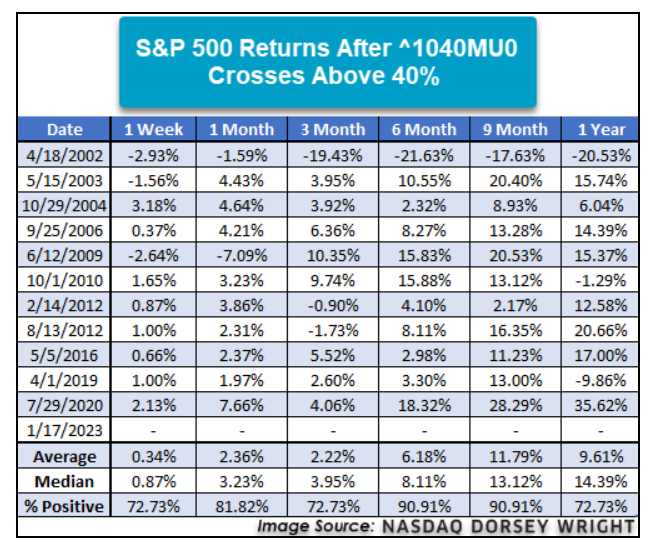

I did see one interesting development last week on the technical analysis front. When the percentage of stocks whose 10-week moving average crosses above its 40-week moving average, it’s referred to as the Golden Cross by technical analysts. This is considered a big positive. When looking at this event over the last 20 years, we see it has a occurred 12 times and has a 70% success rate for positive returns when looking one-year out. The table below from Nasdaq Dorsey Wright shows the results over various time periods leading up to one-year later.

This is just another reason to believe in the strength of the U.S. economy and stock markets.

If you have any questions, please contact me.

The Markets and Economy

- Microsoft announced it is laying off 10,000 employees. The move will affect less than 5% of the company’s global workforce. Google’s parent company said it will lay off 12,00 employees. After ramping up hiring over the last few years due to pandemic-induced sales growth, many tech companies are now reducing worker headcount.

- Existing home sales in the S. saw its weakest year since 2014. The 17.8% drop in home sales is the result of sharply higher mortgage rates and a drop-off in demand that was fueled by the pandemic. Many people moved to the suburbs as work from home rules enticed them to invest in larger homes.

- After reopening from three years of strict Covid controls, China is grappling with shrinking exports, a slump in consumer spending and a declining population. 2022 growth in the world’s second-largest economy shrank to 3%, the lowest in decades. In response, Beijing is easing pressure on technology companies and working to stimulate demand in the housing sector. China announced their population shrank by 850,00 for the first time since 1961.

- Consumers are pulling back on spending in the face of higher prices. The move is giving corporations cause to rethink their price hikes over the last year. This could also help keep inflation in check.

- S. retail sales fell 1.1% in the last month of 2022. The results paint a dismal picture to the end of a year full of recession concerns.

- Lower prices at the producer level are mirroring those consumers are seeing. The Producer Price Index rose 6.2% in December. That’s a significant improvement from November’s3% rate and the 11.2% increase posted in March of 2022.

- The share of S. workers who are members of unions fell to a record low last year even though unions added more members than in any year since 2008. Currently, about 10.1% of wage and salary workers are union members.

- Global leaders met in Davos Switzerland last week for the World Economic Forum. Attendees voiced concern over the slowing global economy, the impact of the war in Ukraine and heavy-handed tactics by the largest nations like China and the U.S.

Offices in Chicago, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This newsletter was prepared by David M. Kover®. To unsubscribe from the Weekly Market Update please write us at 555 Eastport Centre Dr., Suite B, Valparaiso, IN 46383 or click this link: Unsubscribe .

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors LLC, member FINRA/SIPC. Triad is separately owned and other entities and/or marketing names, products or services referenced here are independent of Triad Advisors LLC.

Investment advice offered through One Digital Investment Advisors, LLC, an SEC-registered investment adviser. One Digital Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors LLC.