Last week’s big news came on Thursday as investors digested the latest inflation numbers. After dropping for two consecutive months, the producer-price index (the measure of inflation at the wholesale level) rose to an annualized rate of 8.5%. While that news didn’t have much of an impact on stocks, Thursday’s consumer-price index figures certainly did. Prices at the consumer level rose 8.2% in September from August’s 8.3% increase and June’s 9.1% spike. The CPI number was a slight improvement, but persistently high inflation numbers could result in continued interest rate increases by the Fed. That drove the Dow Jones Industrial Average down about 400 points early in the morning, however, later in the day, traders appeared to believe the selling was overdone. By the time the closing bell rang, the market closed up over 800 points on the day. The DJIA posted a small gain for the week but the S&P 500 and Nasdaq both posted losses.

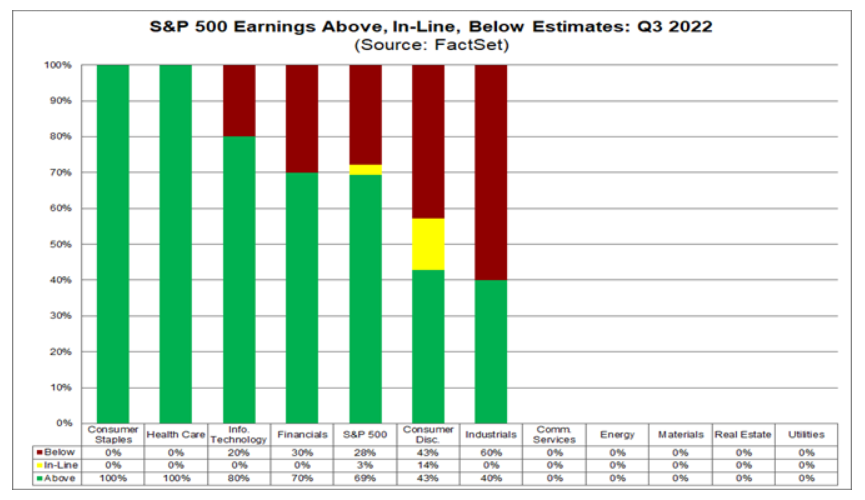

Third quarter earnings season got under way last week with 7% of S&P 500 companies reporting. Of those releasing earnings, 69% have beaten estimates by an average of 0.1%. Banking is typically one of the first sectors to release earnings. Three-fourths of the nations largest banks reported double-digit profit drops on Friday, including a 25% decline at Citigroup. Profits at JPMorgan Chase & Co. fell 17% but both JPMorgan and Citigroup beat analysts expectations. Banks have seen reduced activity in lending as well as an increase in loan-loss reserves. The chart below from FactSet shows our latest earnings season getting under way.

How higher interest rates will continue to impact earnings and the economy will be revealed as third quarter earnings season continues over the next several weeks. I’ll keep you updated here.

If you have any questions, please contact me.

The Markets and Economy

- The K. is facing the biggest shock to its housing market since the 2008 financial crisis. Unlike the U.S. where 30-year fixed rate mortgages are commonly found, most mortgages in Britain see their interest rates reset after two or five years. The reset is expected to affect 2.4 million mortgages out of a total of 8.4 million in the second half of this year.

- The Bull/Bear ratio dropped for the fourth consecutive week to a reading of 0.57. That was the lowest reading since March, 2009 when the stock market began its recovery rally from the financial crisis. The Bull/Bear ratio is considered a contrarian indicator and often marks the bottom of a market correction.

- Retail sales were flat last month as consumers continue to be more cautious with their money.

- The Internal Revenue Service announced it would delay enforcement of new rules for taking required distributions from inherited IRAs until 2023. The statement came as taxpayers, and their financial professionals, have complained about how confusing the changes are.

- Extreme heat and a lack of significant rainfall have severely damaged much of the S. cotton crop this year. America produces about 35% of the world’s cotton.

- 63% of the 2,005 registered voters surveyed in January 2022 support a complete ban on stock trading for all members of Congress. A recent Wall Street Journalreport found that more than 2,600 officials at agencies from the Commerce Department to the Treasury Department, during both Republican and Democratic administrations disclosed stock investments in corporations while those same companies lobbied their agencies for favorable policies.

- After much criticism from several lawmakers and the public, U.K. Prime Minister Liz Truss fired Treasury chief Kwasi Kwarteng and reversed crucial parts of her government’s tax cuts. The tax cuts, the largest since the 1970s, caused an uproar in Parliament as the new coalition was seen as being out of touch with the needs of the people facing crippling inflation and skyrocketing energy costs.

Offices in Chicago, Naples & Valparaiso.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

This newsletter was prepared by David M. Kover®. To unsubscribe from the Weekly Market Update please write us at 555 Eastport Centre Dr., Suite B, Valparaiso, IN 46383 or click this link: Unsubscribe .

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, LLC, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors, LLC.