Major U.S. indices were up last week as investors ready themselves for the beginning of second quarter 2020 earnings season. While many analysts have been cutting their estimates, a few believe earnings will come in better than expected. It’s small consolation for investors who are already scratching their heads over the markets’ sharp rebound over the last three months.

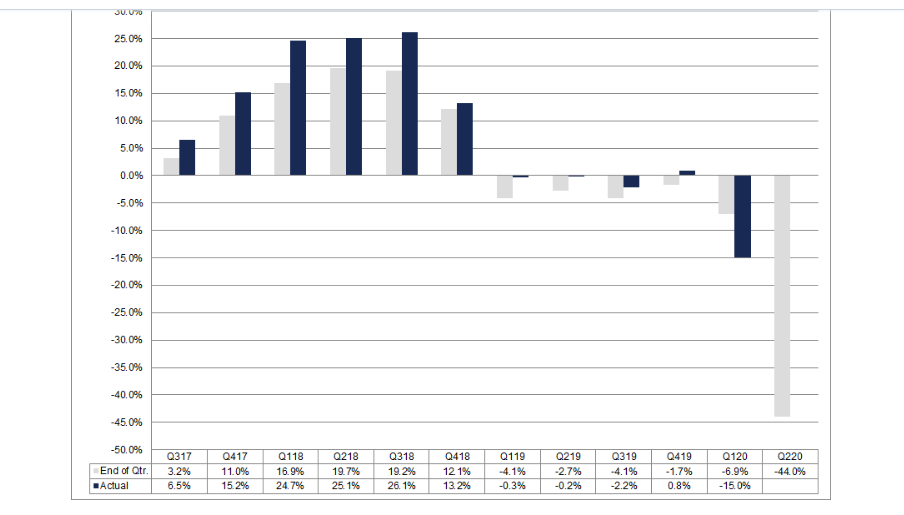

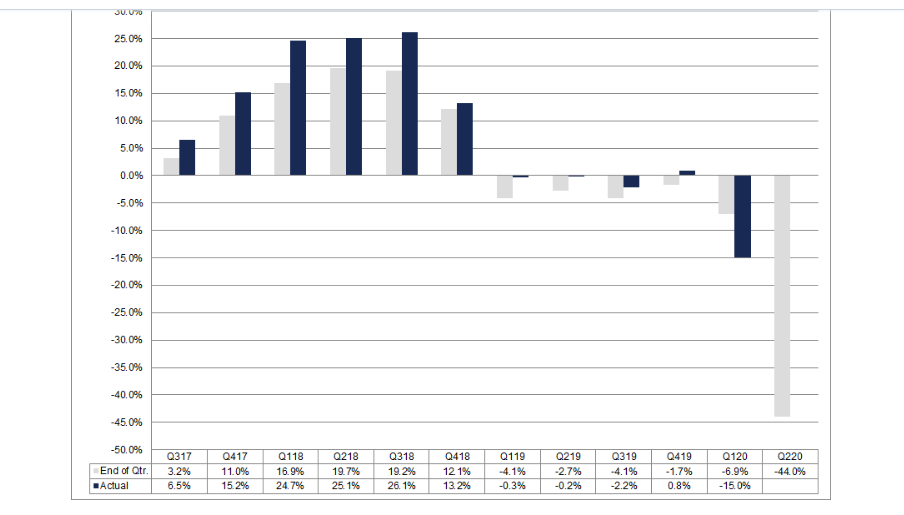

Analysts polled by Refinitiv estimate that second quarter earnings for S&P 500 companies will show a drop of 43.9% from a year earlier. That’s far worse than the 11.7% decline they forecast at the beginning of the second quarter. Interestingly, we’ve seen some improvement in economic numbers during the second quarter but analysts aren’t impressed. For example, at the beginning the second quarter, earnings for industrial stocks in the S&P 500 were estimated to drop 32.8%. Now, analysts are expecting that figure to drop to a whopping 89.1%. The pickup in industrial activity that was reflected in the Institute for Supply Management’s better-than-expected June manufacturing report last week seems not to have hit a chord with analysts.

Similarly, earnings for consumer cyclical companies were expected to slip by 33% at the start of the second quarter. That figure now has been revised to a decline of 109.7% by analysts. Again, while the economic figures have shown some improvement, analysts are getting more negative. May’s retail sales showed a much bigger increase over April’s than economists expected, and June’s retail sales is expected to show even more improvement. So why so much negativity?

An analysts job is not an easy one. It’s much like being a weather forecaster. There’s nothing worse than telling people it will be sunny tomorrow and then see it rain all day. Analysts would rather err on the side of being too negative than being too positive.

Another reason is, 40% of companies in the S&P 500 have withdrawn guidance altogether. This leaves analysts even further in the dark. Some of the techniques analysts use to decipher what is happening with their companies, such as factory tours and store checks, have been put on hold.

The chart below from FactSet shows how bad analysts expect second quarter earnings to be. In fact, if earning do come in over 40%, it will be the worst quarter for earnings since the financial crisis in 2008.

The Markets and Economy

- After dropping 38% in April, purchases of used vehicles have rebounded sharply. Sales of previously owned cars and trucks were up 17% in June. Low interest rates and consumers with federal stimulus checks are the main reasons for the increase in sales.

- Of the 87 firms in the S&P 500 to announce staff reductions from early March through the end of June, 65 chose to furlough workers rather than laying them off permanently. In June, 10.6 million workers were temporarily furloughed. That is down significantly from the peak of 18.1 million in April. Companies believe the temporary layoffs will benefit them later when the U.S. economy rebounds and the need for experienced workers will increase.

- U.S. services industry showed signs of recovery in June. Two surveys of purchasing managers report that demand has started to stabilize and exports were beginning to pick up. June’s reading of 47.9 is up significantly from May’s 37.5 figure. While June’s reading is a marked improvement, a report reading below 50 still shows a contracting economy.

- The airline industry is facing more troubles as the recent spike in Covid-19 cases is resulting in another decrease in travelers. New York, New Jersey and Connecticut said last month they would require people arriving from hot-spot states to quarantine for 14 days. United Airlines said they could layoff 36,000 employees (45% of their workforce) due to reduced travel.

- Brooks Brothers joins a long list of U.S. retailers seeking relief in bankruptcy court. Consumers visiting stores less frequently, more casual workplaces and the pandemic have all taken a toll on the over 200-year old company. They are one of the few remaining brands to make clothes domestically. Those three factories will close on August 15 as the company looks for a new owner.

- Florida has registered a state record of 15,299 new cornavirus cases in a 24 hour period last weekend. That represents 25% of all cases reported in the U.S. that day

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Consult your financial professional before making any investment decision. You cannot invest directly in an index. Past performance does not guarantee future results.

Note: All figures exclude reinvested dividends (if any). Sources: Bloomberg, Dorsey Wright & Associates, Inc. and The Wall Street Journal. Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly.

Securities offered through Triad Advisors, member FINRA/SIPC. Investment advice offered through Resources Investment Advisors, LLC, an SEC-registered investment adviser. Resources Investment Advisors. LLC and Vertical Financial Group are not affiliated with Triad Advisors.